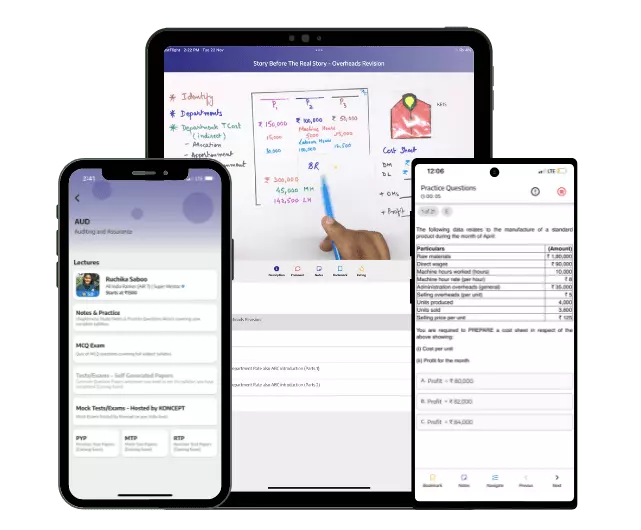

With KONCEPT Save Time, Save Money and Most Importantly Save Attempts

CA Foundation is the entry-level exam for CA Course. Syllabus consists of 4 Papers

Read More

CA Inter is the Second-level exam for CA Course. Syllabus consists of 8 Papers

Read More

CA Inter is the Second-level exam for CA Course. Syllabus consists of 8 Papers

Read More

CA Final is the Third and Final level exam for CA Course. Syllabus consists of 8 Papers

Read More

CSEET is the entry-level exam for CS Course. Syllabus consists of 4 Papers

Read More

CS Executive is second level of the Company Secretary programme. New Syllabus Consists of 7 papers and Old Syllabus Consists of 8 papers

Read More

CS Executive is second level of the Company Secretary programme. New Syllabus Consists of 7 papers and Old Syllabus Consists of 8 papers

Read More

CMA Foundation is the entry-level exam for CMA Course. Syllabus consists of 4 Papers

Read More

CMA Inter is the Second-level exam for CMA Course. Syllabus consists of 8 Papers

Read More

CMA Inter is the Second-level exam for CMA Course. Syllabus consists of 8 Papers

Read More