OVERHEADS - ABSORPTION COSTING METHOD

Table of content

1. INTRODUCTION

Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit. Such expenses are incurred for output generally and not for a particular work order e.g., wages paid to watch and ward staff, heating and lighting expenses of factory etc. Overheads are also very important cost element along with direct materials and direct employees. Often in a manufacturing concern, overheads exceed direct wages or direct materials and at times even both put together. On this account, it would be a grave mistake to ignore overheads either for the purpose of arriving at the cost of a job or a product or for controlling total expenditure.

Overheads also represent expenses that have been incurred in providing certain ancillary facilities or services which facilitate or make possible the carrying out of the production process; by themselves these services are not of any use. For instance, a boiler house produces steam so that machines may run and, without the generation of steam, production would be seriously hampered. But if machines do not run or do not require steam, the boiler house would be useless and the expenses incurred would be a waste.

Overheads are incurred not only in the factory of production but also on administration, selling and distribution.

2. CLASSIFICATION OF OVERHEADS

| |

Description |

Example |

| By Function |

| Factory of Manufacturing or Production Overhead |

Manufacturing overhead is the indirect cost incurred for manufacturing or production activity in a factory. Manufacturing overhead includes all the expenditure from the procurement of materials to teh completion of finished product. |

- stock keeping expenses

- Repairs and maintenance of plant

- Depreciation of factory building

- Indirect labour

- Cost of primary packing

- Insurance of plant and machinery etc. Production overhad include administration costs relating to production, factory, works or manufacturing.

|

| Office and Administrative Overheads |

Office and Administrative overheads are expenditures incurred on all activities relating to general management and administration of an organisation. It includes formulating the policy, directing the organisation and controlling the opreations of an undertaking which is not related directly to production, selling, distrubution, research or development activity or function. |

- Salary paid to office staffs

- Repairs and maintenance of office building

- Depriciation of office building

- Postage and stationery

- Lease rental in case of operating lease (in case of finance lease, lease rental excluding finance cost)

- Accounts and audit expenses etc.

|

| Selling and Distribution Overheads |

- Selling Overhead: expenses related to sale of products and include all indirect expanses in sales and management for the organisation.

- Distribution Overhaed: cost incurred on making product available for sale in the market

|

- Salesmen commission

- Advertisement cost

- Sales office expenses

- Delivery van expenses

- Transit insurance

- Warehouse and cold storage expenses

- Secondary packing expenses

|

| By Nature |

| Fixed Overhead |

These are the costs which are incurred for a period, and which, within certain output and turnover limits, tend to be unaffected by fluctuations in the levels of activity (output or turnover). They do not tend to increase or decrease with the changes in output. |

- Salary paid to permanent employees

- Depriciation of building and plant and equipment

- Interest on capital

- Insurance

|

| Variable Overhead |

These costs tend to vary with the volume of activity. Any increase in the activity results in an increase in the variable cost and vice-versa. |

- Indirect materials

- Power and fuel

- Lubricants

- Tools and spares

|

| Semi-Variable Overheads |

These costs contain both fixed and variable components and are thus partly affected by fluctuations in the level of activity. |

- Electricity cost

- Water cost

- Telephone and internet expenses

|

| By Element |

| Indirect materials |

Materials which do not normally form part of the finished product (cost object) are known as indirect materials. |

- Stores used for maintaining machines and building (lubricants, cotton waste, bricks etc.)

- Stores used by service departments like power house, boiler house, canteen etc.

|

| Indirect employee cost |

Employee costs which cannot be allocated but can be apportioned to or absorbed by cost units or cost centres is known as indirect employee. |

- Salary paid to foreman and supervisor.

- Salary paid to administration staff etc.

|

| Indirect Expenses |

Expenses other than direct expenses are known as indirect expenses, that cannot be directly, conveniently and wholly allocated to cost centres. |

- Rates & taxes

- Insurance

- Depriciation

- Advertisements expenses

|

| By Control |

| Controllable costs |

These are those costs which can be controlled by the implementation of ppropriate managerial influence and proper policies. |

- Materials cost

- Wages and salary

- Power and fuel

|

| Uncontrollable costs |

Overhead costs which cannot be controlled by the management even after the implementation of appropriate managerial influence and proper policies are known as uncontrollable costs. |

- Rates and taxes

- Depriciation

- Interest on borrowings

|

Advantages of Classification of Overheads into Fixed and Variable

The primary objective of segregating semi-variable expenses into fixed and variable is to ascertain marginal costs. Besides this, it has the following advantages also.

- Controlling Expenses: The classification of expenses into fixed and variable components helps in controlling expenses. Fixed costs are generally policy costs, which cannot be easily reduced. They are incurred irrespective of the output and hence are more or less non controllable. Variable expenses vary with the volume of activity and the responsibility for incurring such expenditure is determined in relation to the output. The management can control these costs by giving proper allowances in accordance with the output achieved.

- Preparation of Budget Estimates: The segregation of overheads into fixed and variable part helps in the preparation of flexible budget. It enables a firm to estimate costs at different levels of activity and make comparison with the actual expenses incurred.

- Decision Making: The segregation of semi variable cost between fixed and variable overhead also helps the management to take many important decisions. For example, decisions regarding the price to be charged during depression or recession or for export market. Likewise, decisions on make or buy, shut down or continue, etc., are also taken after separating fixed costs from variable costs.

In fact, when any change is contemplated, say, increase or decrease in production, change in the process of manufacture or distribution, it is necessary to know the total effect on cost (or revenue) and that would be impossible without a correct segregation of fixed and variable costs. The technique of marginal costing, cost volume profit relationship and break-even analysis are all based on such segregation.

3. ACCOUNTING AND CONTROL OF MANUFACTURING OVERHEADS

We have already seen that overheads are by nature those costs which cannot be directly related to a product or to any other cost unit. Yet for working out the total cost of a product or a unit of service, the overheads must be included. Thus, we have to find out a way by which the overheads can be distributed over the various units of production.

One method of working out the distribution of overheads over the various products could be to ascertain the amount of actual overheads and distribute them over the products. This, however, creates a problem since the actual amount of overheads can be known only after the financial accounts are closed. If we wait that long, the cost sheets lose their main advantages and utility to the management. All the decisions for which cost sheets are prepared are immediate decisions and cannot be postponed till the actual overheads are known. Therefore, some method has to be found by which overheads can be included in the cost of the products, as soon as prime cost, the cost of raw materials, direct employees and other direct expenses, is ascertained.

One method is to work out pre-determined rates for absorbing overheads. These rates are worked out before an accounting period begins by estimating the amount of overheads and the level of activity in the ensuing period. Thus, as soon as the prime cost of a product or a job is available, the various overheads are charged by these rates. Of course, this implies that the overheads are charged on an estimated basis. Later, when the actual overheads are known, the difference between the overheads charged to the products and actual overheads is worked out and adjusted.

Manufacturing Overheads: Generally manufacturing overheads form a substantial portion of the total overheads. It is important, that such overheads should be properly absorbed over the cost of production. The following procedure may be adopted in this regard. The steps given below shows how factory overhead rates are estimated and overheads absorbed on that basis and the last one show how actual are compared with the absorbed amount.

1. Estimation and collection of manufacturing overheads: The first stage is to estimate the amount of overheads, keeping in view the past figures and adjusting them for known future changes. The sources available for the collection of factory overheads may include (a) Invoices, (b) Stores requisition, (c) Wage analysis book (d) Journal entries. etc.

2. Assignment of Manufacturing Overheads: The guiding principle for assignment of manufacturing overheads to a cost object is the traceability of the overheads in an economically feasible manner.

Assignment of the manufacturing overhead is done on the basis of either of the following two principles:

- Cause and Effect: Cause is the process or operation or activity and effect is the incurrence of cost.

- Benefit received: Manufacturing overheads are to be apportioned to various cost objects in proportion to the benefits received by them.

- Cost Allocation: The term ‘allocation’ refers to the direct assignment of cost to a cost object which can be traced directly. It implies relating overheads directly to the various departments. The estimated amount of various items of manufacturing overheads should be allocated to various cost centres or departments. For example- if a separate power meter has been installed for a department, the entire power cost ascertained from the meter is allocated to that department. The salary of the works manager cannot be directly allocated to any one department since he looks after the whole factory. It is, therefore, obvious that many overhead items will remain unallocated after this step.

- Cost Apportionment: There are some items of estimated overheads (like the salary of the works manager) which cannot be directly allocated to the various departments and cost centres. Such unallocable expenses are to be spread over the various departments or cost centres on the basis of two principles. This is called apportionment. Thus, apportionment implies “the allotment of proportions of items of cost to cost centres or departments”. After this stage, all the overhead costs would have been either allocated to or apportioned over the various departments.

- Re-apportionment: Upto the last stage all overheads are allocated and apportioned to all the departments- both production and service departments. Service departments are those departments which do not directly take part in the production of goods or providing services. Such departments provide auxiliary services across the entity and renders services to other cost centres and in some cases to outside parties. Examples of such departments are engineering, quality control and assurance, laboratory, canteen, stores, time office, dispensary etc. The overheads of these departments are to be shared by the production departments since service departments operate primarily for the purpose of providing services to production departments. The process of assigning service department overheads to production departments is called reassignment or re-apportionment. At this stage, all the factory overheads are collected under production departments.

3. Absorption: After completing the distribution as stated above the overheads charged to department are to be recovered from the output produced in respective departments. This process of recovering overheads of a department or any other cost center from its output is called recovery or absorption.

Absorption of manufacturing overheads shall be as follows:

- Variable Manufacturing overheads: The variable manufacturing overheads shall be absorbed on the basis of actual production.

- Fixed Manufacturing overheads: The fixed manufacturing overhead shall be absorbed on the basis of normal capacity.

The overhead expenses can be absorbed by estimating the overhead (as assigned above) and then working out an absorption rate. When overheads are estimated, their absorption is carried out by adopting a pre-determined overhead absorption rate. This rate can be calculated by using any one method as discussed in this chapter at the end.

As the actual accounting period begins, each unit of production automatically absorbs a certain amount of factory overheads through pre-determined rates. During the year a certain amount will be absorbed over the various products. This is known as the total amount of absorbed overheads.

4. Treatment of over and under absorption of overheads: After the year end the total amount of actual factory overheads is known. There is bound to be some difference between the actual amount of overheads and the absorbed amount of overheads. So, the overheads are generally either under-absorbed or over-absorbed. The difference has to be adjusted keeping in view of such differences and the reasons therefore.

Students will thus see that the whole discussion as above is meant to serve the following two purposes:

- to charge various products and services with an equitable portion of the total amount of factory overheads; and

- to charge factory overheads immediately as the product or the job is completed without waiting for the figures of actual factory overheads.

4. STEPS FOR THE DISTRIBUTION OF OVERHEADS

The various steps for the distribution of overheads have been discussed in detail as below:

1. Estimation and Collection of Overheads

The amount of overheads is required to be estimated. The estimation is usually done with reference to past data adjusted for known future changes. The overhead expenses are usually collected through a system of standing orders.

Standing Orders: In every manufacturing business, expenses are incurred on direct materials and direct labour in respect of several jobs or other units of production. Incurrence of these expenses are authorised by production orders or work orders. The term “Standing Order” denotes sanction for indirect expenses under various heads of expenditure.

In large factories, usually the classification of indirect expenditures is combined with a system of Standing Orders (sometimes also referred as Service “Orders”). It is a system under which a number is allotted to each item of expense for the purpose of identification, and the same is continued from year to year. The extent of such analysis and the nomenclature adopted are settled by the management according to the needs of the industry.

2. AllocationofOverheadsovervariousDepartmentsor Departmentalisation of Overheads

Most of the manufacturing processes functions are performed in different departments of a factory. Some of the departments of the factory are engaged in production process while few may function as ancillary departments. The ancillary departments are service departments supporting the production departments in manufacturing, administration, selling & distribution of goods or services.

Factory overheads which are related to any of the production or service departments are allocated to these departments.

A department may be sub-divided into various cost centres for better cost control and performance evaluation. It is thus obvious that the principal object of setting up cost centres is to collect data, in respect of similar activities more conveniently. This avoids a great deal of cost analysis. When costs are collected by setting up cost centres, several items can be ascertained definitely and the element of estimation is reduced considerably. For instance, the allowance of the normal idle time or the amount to be spent on consumable stores, etc. There are two main types of cost centres - machine or personal - depending on whether the process of manufacture is carried on at a centre by man or machine. For the convenience of recording of expenditure, cost centres are sometimes allotted a code number.

Advantages of Departmentalisation: The collection of overheads department wise gives rise to the following advantages:

- Better Estimation of Expenses: Some expenses which relate to the departments will be estimated almost on an exact basis and, to that extent, the accuracy of estimation of overheads will be higher.

- Better Control: For the purpose of controlling expenses in a department, it is obviously necessary that the figures in relation to each department should be separately available. It is one of the main principles of control that one should know for each activity how much should have been spent and how much is actually spent. If information about expenses is available only for factory as a whole, it will not be possible to know which department has been over spending.

- Ascertainment of Cost for each department: From the point of view of ascertaining the cost of each job, the expenses incurred in the departments through which the job or the product has passed should be known. It is only then that the cost of the job or the product can be charged with the appropriate share of indirect expenses. It is not necessary that a job must pass through all the departments or that the work required in each department should be the same for all jobs. It is, therefore, necessary that only appropriate charge in respect of the work done in the department is made. This can be done only if overheads for each department are known separately.

- Suitable Method of Costing: A suitable method of costing can be followed differently for each department e.g., batch costing when a part is manu- factured, but single or output costing when the product is assembled.

3. Apportioning overhead expenses over various departments

Overheads which are related to more than one department are required to be distributed between/ among the departments. This distribution of overheads between/ among the departments is called apportionment. The example of overheads may include e.g. rent of building, power, lighting, insurance, depreciation etc. To apportioning these overheads over different departments benefiting thereby, it is necessary at first to determine the proportion of benefit received by each department and then distribute the total expenditure proportionately on that basis. But the same basis of apportionment cannot be followed for different items of overheads since the benefit of service to a department in each case has to be measured differently. Some of the bases that may be adopted for the apportionment of expenses are stated below:

| Overhead Cost |

Bases of Apportionment |

- Rent and other building expenses

- Lighting and heating (conditioning)

- Fire precaution service

- Air-conditioning

|

Flooe area, or volume of department |

- Perquisites

- Labour welfare expenses

- Time keeping

- Personnel office

- Supervision

|

Number of workers |

- Compensation to workers

- Holiday pay

- ESI and PF contribution

- Perquisites

|

Direct wages |

| General overhead |

Direct labour hour, or Direct wages, or Machine hours |

- Depreciation of plant and machinery

- Repairs and maintenance of plant and machinery

- Insurance of stock

|

Capital values |

- Power/steam consumption

- Internal transport

- Managerial salaries

|

Technical estimates |

| Lighting expenses (light) |

No. of light points, or Area or Metered units |

| Electric power (machine operation) |

Horse power of machines or Number of machine hour or value of machines or units consumed |

- Material handling

- Stores overhead

|

Weight of materials or volume of materials or unit of materials |

Some other basis of apportioning overhead costs: We have considered already that the benefit received by the department generally is the principal criterion on which the costs of service departments or common expenses are apportioned. But other bases of apportionments which may be used are mentioned below:

- Analysis or survey of existing conditions.

- Ability to pay.

- Efficiency or incentive.

A concern may have predominantly only one criterion or may use all (including the service or benefit criterion) for different phases of its activity.

Analysis or Survey of existing conditions: At times it may not be possible to determine the advantage of an item of expenses without undertaking an analysis of expenditure. For example, lighting expenses can be distributed over departments only on the basis of the number of light points fixed in each department.

Ability to pay: It is a principle of taxation which has been applied in cost accounting as well for distributing the expenditure on the basis of income of the paying department, on a proportionate basis. For example, if a company is selling three different products in a territory, it may decide to distribute the expenses of the sales organisation to the amount of sales of different articles in these territories. This basis, though simple to apply, may be inequitable since the expenditure charged to an article may have no relation to the actual effort involved in selling it. Easy selling lines thus may have to bear the largest proportion of expenses while, on the other hand, these should bear the lowest charge.

Efficiency or Incentives: Under this method, the distribution of overheads is made on the basis of pre-determined levels of production or sales. When distribution of overhead cost is made on this basis and if the level of production exceeds the pre- determined level of production the incidence of overhead cost gets reduced and the total cost per unit of production or of sales, lowered. The opposite is the effect if the assumed levels are not reached.

Thus, the department whose sales are increasing is able to show a greater profit and thereby is able to earn greater goodwill and appreciation of the management than it would have if the distribution of overheads was made otherwise.

Difference between Allocation and Apportionment

The difference between the allocation and apportionment is important to understand because the purpose of these two methods is the identification of the items of cost to cost units or centers. However, the main difference between the above methods is given below.

| Allocation |

Apportionment |

| Allocation deals with the whole items of cost, which are identifiable with any on edepartment. For example, indirect wages of three departments are seperately obtained and hence each department will be charged by the respective amount of wages individually. |

Apportionment deals with the proportions of an item of cost for example; the cost of the benefit of a service department will be divided between those department which has availed those benefits. |

| Allocation is a direct process of chargeing expenses to different cost centres |

Apportionment is an indirect process because there is a need for the identification of the appropriate portion of an expense to be borne by the different departments benefitted. |

The allocation or apportionment of an expense is not dependent on its nature, but the relationship between the expense and the cost centre decides that whether it is to be allocated or apportioned.

Allocation is a much wider term than apportionment.

4. Re-apportionment of service department overheads over production departments

The re-apportionment of the service department cost to the production department is known as secondary distribution. The suggestive bases that may be adopted for re-apportionment are given below:

| Cost of the Service Departments |

Basis |

| Manitenance and repair shop |

Direct labour hours, Machine hours, Direct labour wages, Asset value x Hours worked |

| Planning and progress |

| Tool room |

| Canteen and Welfare |

No. of direct workers

No. of employees etc. |

| Hospital and Dispensary |

| Personnel Department |

| Time-keeping |

No. of card punched, No. of employees |

| Computer Section |

Computer hours, Specific allocation to departments |

| Power house (electric lighting cost) |

Floor area, cubic content, No. of electric points, wattage |

| Power house (electric power cost) |

House power, Kwh, Horse power x Machine hours, Kwh x Machine hours |

| Stores Department |

No. of reuisitions, Weight or value of Materials issued |

| Transport Department |

Crane hours, Truck hours, Truck mileage, Tuck tonnage, Truck ton-hours, Tonnage handled, No. of pakages of Standard size |

| Fire protection |

Capital values |

| Inspection |

Inspection hours |

Notes:

- Repairs included in repairs shop cost, building maintenance cost included in maintenance shop cost etc. should be apportioned on the basis of capital values.

- Economy, practicability, equitability and reliability are the matters of consideration for selection of the base.

Methods for Re-apportionment: The re-apportionment of service department expenses over the production departments may be carried out by using any one of the following methods:

(i) Direct Re-Distribution Method: Service department costs under this method are apportioned over the production departments only, ignoring the services rendered by one service department to the other. To understand the applications of this method, go through the illustration which follows.

(ii) Step Method or Non-reciprocal method: This method gives cognizance to the services rendered by service department to another service department. Therefore, as compared to previous method, this method is more complicated because a sequence of apportionments has to be selected here. The sequence here begins with the department that renders maximum number of services to the other service department(s). In other words, the cost of the service department that serves the largest number of services to the other service department(s) and production department(s) is distributed first. After this, the cost of service department serving the next largest number of departments is apportioned.

This process continues till the cost of last service department is apportioned. The cost of last service department is apportioned among production departments only.

Some authors are of the view that the cost of service department with largest amount of cost should be distributed first.

(iii) Reciprocal Service Method: This method recognises the fact that where there are two or more service departments they may render services to each other and, therefore, these inter-departmental services are to be given due weight while re- distributing the expenses of the service departments.

The methods available for dealing with reciprocal services are:

- Simultaneous Equation Method: According to this method firstly, the costs of service departments are ascertained. These costs are then re-distributed to production departments on the basis of given percentages.

- Trial and Error Method: According to this method the cost of one service cost centre is apportioned to another service cost centre. The cost of another service centre plus the share received from the first cost centre is again apportioned to the first cost centre. This process is repeated till the amount to be apportioned becomes negligible, that means repeated distribution method is followed to the extent of service departments only. All apportioned amounts for each service cost centre are added to get the total apportioned cost. These total service cost centre costs are redistributed to the production departments. Trial and error method and Simultaneous equation method gives the same result.

- Repeated Distribution Method: Under this method, service departments’ costs are distributed to other service and production departments on agreed percentages and this process continues to be repeated, till the figures of service departments are either exhausted or reduced to too small a figure.

5. Absorbing overheads over cost units, products, etc.

Collection of the figure of overheads for the factory as a whole or for various departments is not enough. It is clearly necessary to ascertain how much of the overheads is to be debited to the cost of the various jobs, products etc. This process is called absorbing the overhead to cost units. We take up below the various implica- tions of this process. However, if only one uniform type of work is done, the task is easy and under such a situation the overhead expenses to be absorbed may be calculated by dividing actual overheads by the number of units of work done or estimated overheads by the estimated output.

5. METHODS OF ABSORBING OVERHEADS TO VARIOUS PRODUCTS OR JOBS

The method selected for charging overheads to products or jobs should be such as will ensure:

(i) that the total amount charged (or recovered) in a period does not differ materially from the actual expenses incurred in the period. and

(ii) that the amount charged to individual jobs or products is equitable. In case of factory overhead, this means:

- that the time spent on completion of each job should be taken into consideration;

- that a distinction should be made between jobs done by skilled workers and those done by unskilled workers. and

- that jobs done by manual labour and those done by machines should be distinguished.

In addition, the methods should be capable of being used conveniently; and yield uniform result from period to period as far as possible; any change that is apparent should reflect a change in the underlying situation such as substitution of human labour by machines.

Several methods are commonly employed either individually or jointly for computing the appropriate overhead rate. The more common of these are:

- Percentage of direct materials,

- Percentage of prime cost,

- Percentage of direct labour cost,

- Labour hour rate,

- Machine hour rate and

- Rate per unit of Output

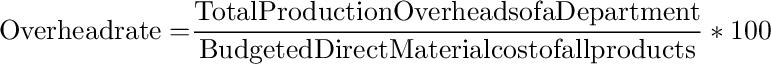

Percentage of Direct material cost

Under this method, the cost of direct material consumed is the base for calculating the amount of overhead absorbed. This overhead rate is computed by the following formula:

Percentage of Prime cost method

Percentage of Prime cost method

This method is based on the fact that both materials as well as labour contribute in raising factory overheads. Hence, the total of the two i.e. Prime cost should be taken as base for absorbing the factory overhead. The overhead rate in this method is computed by the following formals:

Example for the above two methods:

Suppose for a given period, actual figures are estimated as follows:

Direct materials 2,00,000

Direct labour 1,00,000

Factory overheads 90,000

The percentage of factory overheads to direct materials will be 45%, to prime cost 30%. If, on a job, material cost is Rs. 10,000 and direct labour is Rs.7,000 the cost, after absorbing factory overhead, will be as follows:

(i) Rs.17,000 + 45% Rs.10,000 or Rs.21,500,

(ii) Rs.17,000 + 30% Rs.17,000 or Rs.22,100, and

One can see how, with a different method, the works cost comes out to be different. Of these methods, the first and second are generally considered to be unsuitable on account of the following reasons:

- Manufacturing overhead expenses are mostly a function of time i.e., time is the determining factor for the incurrence and application of manufacturing overhead expenses. That they are so would be clear if we recall that overhead expenses, specially manufacturing expenses, can in the ultimate analysis be regarded as expenditure incurred in providing the necessary facilities and service to workers employed in the productive process. The question of facilities and service made available to workers naturally is dependent on the length of time during which workers make use of the facilities. It may, therefore, be said that the job or product on which more time has been spent would entail larger manufacturing expenses than the job requiring less time. The factor is ignored altogether by the first method and largely by the second method.

- Overheads are neither related to the prime cost nor to direct material cost except to a very small extent. Thus, if the percentage of material cost is used when there are two jobs requiring the same operational time but using material having varying prices, their manufacturing overhead cost would be different whereas this should not normally be so.

The method of absorbing overhead costs on the basis of prime cost also does not take into consideration the time factor. The fact that the amount includes labour cost in addition to material cost does not render the prime cost to be more suitable; infact, the results are liable to be more misleading because of the cumulative error of using both the labour and material cost as the basis of allocation of overhead expenses, on neither of which they are already dependent.

- Since material prices are prone to frequent and wide fluctuations, the manufacturing overheads, if based on material cost or prime cost, also would fluctuate violently from period to period.

- The skill of the workers involved and whether machines were used or not, are ignored when these methods are used.

Percentage of materials cost may, however, be used for the limited purpose of absorbing material handling and store overheads.

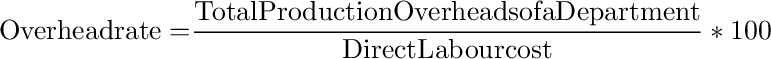

Percentage of direct labour cost

Formula to be used under this method is-

Direct Labour Cost Percentage Rate

| Advantages |

Disadvantages |

- The method is simple and economical to apply

- The time factor is given recognition even if indirectly.

- Total expenses recovered will not differ much from the estimated figure since total wages paid are not likely to fluctuate much.

|

- It gives rise to certain inaccuracies due to the time factor not being given full importance.

- Where machinery is used to same extent in the process of amnufacture, an allowance for such a factor is not made.

- It does not provide for varying skills of workers.

|

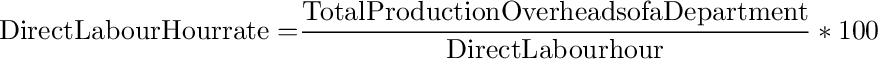

Labour hour rate Method

This method is an improvement on the percentage of direct wage basis, as it fully recognises the significance of the element of time in the incurring and absorption of manufacturing overhead expenses. This method is admirably suited to operations which do not involve any large use of machinery. To calculate labour hour rate, the amount of factory overheads is divided by the total number of direct labour hours. Suppose factory overheads are estimated at Rs.90,000 and labour hours at 1,50,000. The overhead absorption rate will be Rs.0.60. If 795 direct labour hours are spent on a job, Rs.477 will be absorbed as overhead. It can be calculated for each category of workers.

Formula to be used under this method is-

Machine hour rate

Machine hour rateMachine hour rate implies, cost of running a machine for an hour to produce goods. There are two methods of computing machine hour rates:

- Direct Machine hour rate: According to the first method, only the expenses directly or immediately connected with the operation of the machine are taken into account e.g., power, depreciation, repairs and maintenance, insurance, etc. The rate is calculated by dividing the estimated total of these expenses for a period by the estimated number of operational hours of the machines during the period.

- Comprehensive Machine hour rate: It will be obvious, however, that in addition to the expenses stated above there may still be other manufacturing expenses such as supervision charges, shop cleaning and lighting, consumable stores and shop supplies, shop general labour, rent and rates, etc. incurred for the department as a whole and, hence, not charged to any particular machine or group of machines. In order to see that such expenses are not left out of production costs, one should include a portion of such expenses to compute the machine hour rate. Alternatively, the overheads not directly related to machines may be absorbed on the basis of Productive Labour Hour Rate Method or any other suitable method.

Note: Some people even prefer to add the wages paid to the machine operator in order to get a comprehensive rate of working a machine for one hour.

By the machine hour rate method, manufacturing overhead expenses are charged to production on the basis of number of hour machines are used on jobs or work orders. Here each machine or group of machines is treated as a cost centre. Overheads

apportioned to a production department are further apportioned to machines or

group of machines. These apportioned costs are divided by the estimated productive machine hour to get machine hour rate.

The steps involved in determining of Machine hour rate are as follows:

The above costs are further divided into fixed cost or standing charges and variable cost. Costs which remain constant irrespective of operation of machine are treated as fixed cost or standing charges. Examples of fixed cost include insurance premium for machine, rent for premises, supervisor’s salary, depreciation (if relates to effluxion of time) etc.

Costs which vary with the operation of the machine are treated as variable cost. Examples of variable cost include cost for power, cost for consumables (lubricants, oils etc.), repairs and maintenance, depreciation (if it relates to activity) etc.

Advantages and disadvantages of Machine hour rate:

| Advantages |

Disadvantages |

- Where machines are the main factor of production, it is usually the best method of charging machine operating expenses to production.

- The under-absorption of machine overheads would indicate the extent to which the machines have been idle.

- It is particularly advantageous where one operator attends to several machines (e.g. automatic screw manufacturing machine), or where several operators are engaged on the machine e.g. the belt press used in making conveyor belts.

|

- Additional data concerning the operation time of machines, not otherwise necessary, must be recorded and maintained.

- As general department rates for all the machines in a department may be suitable, the computation of a seperate machine hour rate for each machine or group of machines would mean further additional work.

|

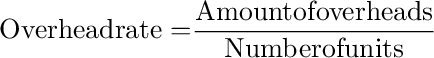

Rate per unit of output method

This is the simplest of all the methods. In this method overhead rate is determined by the following formula:

6. TYPES OF OVERHEAD RATES

The overhead rates may be of the following types:

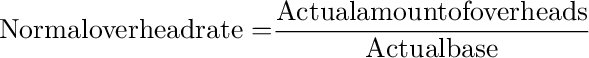

1. Normal Rate: This rate is calculated by dividing the actual overheads by actual base. It is also known as actual rate.

It is calculated by the following formula:

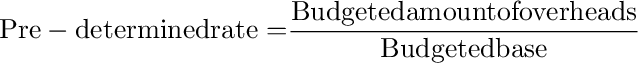

2. Pre-determined Overhead Rate:

2. Pre-determined Overhead Rate: This rate is determined in advance by estimating the amount of the overhead for the period in which it is to be used. It is computed by the following formula:

The amount of overhead rate of expenses for absorbing them to production may be estimated on the following three bases.

- The figure of the previous year or period may be adopted as the overhead rate to be charged to production in the current year. The assumption is that the value of production as well as overheads will remain constant or that the two will change, proportionately.

- The overhead rate for the year may be determined on the basis of estimated expenses and anticipated volume of production activity. For instance, if expenses are estimated at Rs.10,000 and output at 4,000 units, the overhead rate will be Rs.2.50 per unit.

- The overhead rate for a year may be fixed on the basis of the normal volume of the business.

3. Blanket Overhead Rate: Blanket overhead rate refers to the computation of one single overhead rate for the whole factory. It is to be distinguished from the departmental overhead rate which refers to a separate rate for each individual cost centre or department. The use of blanket rate may be proper in certain factories producing only one major product in a continuous process or where the work performed in every department is fairly uniform or standardised.

This overhead rate is computed as follows:

A blanket rate should be applied in the following cases:

(1) Where only one major product is being produced.

(2) Where several products are produced, but

- All products pass through all departments; and

- All products are processed for the same length of time in each department. Where these conditions do not exist, departmental rates should be used.

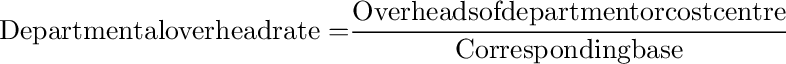

4. Departmental Overhead Rate: It refers to the computation of one single overhead rate for a particular production unit or department. Where the product lines are varied or machinery is used to a varying degree in the different departments, that is, where conditions throughout the factory are not uniform, the use of departmental rates is to be preferred.

This overhead rate is determined by the following formula:

7. TREATMENT OF UNDER-ABSORBED AND OVER–ABSORBED OVERHEADS IN COST ACCOUNTING

Overhead expenses are usually applied to production on the basis of pre-determined rates. Production overheads are to be determined in advance for fixing selling price, quote tender price and to formulate budgets etc.

The actual overhead rate will rarely coincide with the pre-determined overhead rate, due to variation in pre-determined overhead rate and actual overhead rate. Such a variation may arise due to any one of the following situations:

- Estimated overheads for the period under consideration may remain the same or they coincide with actual overheads but the number of units produced during the period is either more or less in comparison with budgeted figure. In the former case actual overhead rate will be less and in the latter case, actual overhead rate will be more than the pre-determined overhead rate, hence over-absorption and under-absorption will occur respectively.

- Similarly, if the number of units actually produced during the period remains the same as budgeted figure but the actual overheads incurred are more or less than the estimated overheads for the period, then a situation of under- absorption or over-absorption will arise respectively.

- If changes occur in different proportion both in the actual overheads and in the number of units produced during the period, then a situation of under or over-absorption (depending upon the situation) will arise.

- If the changes in the numerator (i.e. in actual overheads) and denominator (i.e. in number of units produced) occur uniformly (without changing the proportion between the two) then a situation of neither under nor of over- absorption will arise.

Such over or under-absorption as arrived at under different situations may also be termed as overhead variance. The amount of over-absorption being represented by a credit balance in the accounts and the amount of under- absorption as a debit balance.

The situations of under/ over absorption can be summarized as below:

When the absorbed amount is less than the actual amount it is called under- absorption. Similarly, when the absorbed amount is more than the actual amount it is called over-absorption.

| Budgeted Figure |

Actual Figure |

Abosrbed Amount |

Diffference |

Result |

| Amount |

Units |

Amount |

Units |

Under/Over absorption |

| 1 |

2 |

3 |

4 |

5=1/2*4 |

6=3-5 |

| 100 |

100 |

110 |

100 |

100 |

10 |

Under-absorption |

| 100 |

100 |

90 |

100 |

100 |

-10 |

Over-absorption |

| 100 |

100 |

100 |

90 |

90 |

10 |

Under-absorption |

| 100 |

100 |

100 |

110 |

110 |

-10 |

Over-absorption |

| 100 |

100 |

90 |

90 |

90 |

0 |

No Under/over-absorption |

| 100 |

100 |

110 |

110 |

110 |

0 |

No Under/over-absorption |

| 100 |

100 |

110 |

90 |

90 |

20 |

Under-absorption |

| 100 |

100 |

90 |

110 |

110 |

-20 |

Over-absorption |

In above example Pre-determined rate is 100/100 units =Rs.1

Treatment of under/ over absorption of overheads in cost accounting:

s regards the treatment of such debit or credit balances, the general view is that if the balances are small they should be transferred to the Costing Profit and Loss Account and the cost of individual products should not be increased or reduced as these would be representing normal cost.

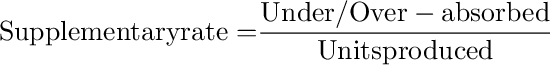

Where, however the difference is large and due to wrong estimation, it would be desirable to adjust the cost of products manufactured, as otherwise the cost figures would convey a misleading impression. Such adjustments usually take the form of supplementary rates. Supplementary rate is calculated as below:

Supplementary overhead rate as calculated above is applied to finished goods, semi-finished goods (WIP) and goods finished and sold. Therefore, under/ over absorbed overheads are distributed among the unsold stock of finished goods, semi-finished goods (WIP) and cost of sales (goods produced and sold).

The accounting is done as follows:In case of Under-absorption:

| Accounts |

Dr/Cr |

Calculation of amount |

| Stock of Finished goods A/c |

Debit |

Units of finished stock x Supplementary rate per unit |

| Stock of semi-finished goods (WIP) A/c |

Debit |

Equivalent completed units x Supplementary rate per unit |

| Cost of Sales A/c |

Debit |

Units sold x Supplementary rate per unit |

In case of Under-absorption:

| Accounts |

Dr/Cr |

Calculation of amount |

| Stock of Finished goods A/c |

Credit |

Units of finished stock x Supplementary rate per unit |

| Stock of semi-finished goods (WIP) A/c |

Credit |

Equivalent completed units x Supplementary rate per unit |

| Cost of Sales A/c |

Credit |

Units sold x Supplementary rate per unit |

8. ACCOUNTING AND CONTROL OF ADMINISTRATIVE OVERHEADS

Definition - According to CIMA Terminology, Administrative overhead is defined as “The sum of those costs of general management and of secretarial accounting and administrative services, which cannot be directly related to the production, marketing, research or development functions of the enterprise.” According to this definition, administrative overhead constitutes the expenses incurred in connection with the formulation of policy directing the organisation and controlling the operations of an undertaking. These overheads are also collected and classified in the same way as the factory overheads.

Accounting of Administrative Overheads

There are three distinct methods of accounting of administrative overheads, which are briefly discussed below:

(a) Apportioning Administrative Overheads between Production and Sales Departments: According to this method administrative overheads are apportioned over production and sales departments. The reason for the apportionment of overhead expenses over these departments, recognises the fact that administrative overheads are incurred for the benefit of both of these departments. Therefore, each department should be charged with the proportionate share of the same. When this method is adopted, administrative overheads lose their identity and get merged with production and selling and distribution overheads.

Disadvantages:

- It is difficult to find suitable bases of administrative overhead apportionment over production and sales departments.

- Lot of clerical work is involved in apportioning overheads.

- It is not justified to apportion total administrative overheads only over production and sales departments when other equally important department like finance is also there.

(b) Charging to Profit and Loss Account: According to this method administrative overheads are charged to Costing Profit & Loss Account. The reason for charging to Costing Profit & Loss are firstly, the administrative overheads are concerned with the formulation of policies and thus are not directly concerned with either the production or the selling and distribution functions. Secondly, it is difficult to determine a suitable basis for apportioning administrative overheads over production and sales departments. Lastly, these overheads are the fixed costs. In view of these arguments, administrative overheads should be charged to Profit and Loss Account.

Disadvantages:

- Cost of products is understated as administrative overheads are not charged to costs.

- The exclusion of administrative overheads from cost of products is against sound accounting principle.

(c) Treating Administrative Overheads as a separate addition to Cost of Production/ Sales: This method considers administration as a separate function like production and sales and, as such costs relating to formulating the policy, directing the organisation and controlling the operations are taken as a separate charge to the cost of the jobs or a product, sold along with the cost of other functions. The bases which are generally used for apportionment are:

- Works cost

- Sales value or quantity

- Gross profit on sales

- Quantity produced

- Conversion cost, etc.

Control of Administrative Overheads

Mostly administrative overheads are of fixed nature, and they arise as a result of management policies. These fixed overheads are generally non-controllable. But at the same time these overheads should not be allowed to grow disproportionately. Some degree of control has to be exercised over them. The methods usually adopted for controlling administrative overheads are as follows:

- Classification and analysis of overheads by administrative departments according to their functions, and a comparison with the accomplished results: According to this method the expenses incurred by each administrative department are collected under a standing order for each class of expenditure. These are compared with similar figures of the previous period in relation to accomplishment. Such a comparison will reveal efficiency or inefficiency of the concerned department.

However, this method provides only a limited degree of control and comparison does not give useful results if the level of activity is not constant during the periods under comparison. To overcome this difficulty, overhead absorption rates may also be compared from period to period; the extent of over or under absorption will reveal the efficiency or otherwise of the department. It may be possible to compare the cost of a service department with that of similar services obtainable from outside and a decision may be taken whether it is economical to continue the department or entrust the work to outsiders.

- Control through Budgets - According to this method, administration budgets (monthly or annually) are prepared for each department. The budgeted figures are compared with actual ones to determine variances. The variances are analysed and responsibility assigned to the concerned department to control these variances.

- Control through Standard - Under this method, standards of performance are fixed for each administrative activity, and the actual performance is compared with the standards set. In this way, standards serve not only as yardstick of performance but also facilitate control of costs.

9. ACCOUNTING AND CONTROL OF SELLING AND DISTRIBUTION OVERHEADS

Selling cost or overhead expenses are the expenses incurred for the purpose of promoting the marketing and sales of different products. Distribution expenses, on the other hand, are expenses relating to delivery and dispatch of goods sold. Examples of selling and distribution expenses have been considered earlier in this

booklet. From the definitions it is clear that the two types of expenses represent

two distinct type of functions. Some concerns group together these two types of overhead expenses into one composite class, namely, selling and distribution overhead, for the purpose of Cost Accounting.

Accounting of selling and distribution overheads

The collection and accumulation of each expense is made by means of appropriate standing orders in the usual way. Where it is decided to apportion a part of the administrative overhead to the selling division the same should also be collected through appropriate standing orders.

As in the case of administrative overheads, it is not easy to determine an entirely satisfactory basis for computing the overhead rate for absorbing selling overheads. The bases usually adopted are:

- Sales value of goods;

- Cost of goods sold;

- Gross Profit on sales; and

- Number of orders or units sold.

It is considered that the sale value is ordinarily the most logical basis, there being some connection between the amount of sales and the amount of expenses incurred to achieve them. The cost of production, however, is not as satisfactory basis as it may not have any direct relationship with the selling and distribution cost.

The basis of gross profit on sales results in a larger share of the selling overhead being applied to goods yielding a large margin of profit and vice versa. The basis therefore follows the principle of ‘ability to pay, it may not reflect costs or incurred efforts.

An estimated amount per unit - The best method for absorbing selling and distributing expenses over various products is to separate fixed expenses from variable expenses. Apportion the fixed expenses according to the benefit derived by each product and thus ascertaining the fixed expenses per unit. We give below some of the fixed expenses and the basis of apportionment:

| Expenses |

Basis |

| Salaries in the Sales Department and of the sales men |

Estimated time devoted to the sale of various products |

| Advertisement |

Actual amount incurres for each product since these days it isusual to advertise each product seperately; common expenses, such as in an exhibition, should be apportioned on the basis of advertisement expenditure on each product |

| Show room expenses |

Average space occupied by each product |

| Rent of finished goods godowns and Expenses on own delivery vans |

Average quantities delivered during a period |

If a suitable basis for apportioning expenses does not exist it may be apportioned in the proportion of sales of various products.

The total of fixed expenses apportioned in this manner, divided by the number of units sold or likely to be sold, will give the fixed expenses per unit. To this should be added the variable expenses which will be different for each product. These expenses are, packaging, freight outwards, insurance in transit, commission payable to salesmen, rebate allowed to customers, etc. All these items will be worked out per unit for each product separately. These items added to fixed expenses per unit will give an estimated amount of the selling and distribution expenses per unit.

Control of Selling & Distribution Overheads

Control of selling and distribution expenses is a difficult task. The reasons for this are as follows:

- The incidence of selling and distribution overheads depends mainly on external factors, such as distance of market, extent and nature of competition, terms of sales, etc. which are beyond the control of management.

- These overheads are dependent upon the customers, behaviour, their liking and disliking, tastes etc. Therefore, as such control over the overheads may result in loss of customers.

- These expenses being of the nature of policy costs are not amenable to control.

In spite of the above difficulties, the following methods may be used for controlling them.

- Comparison with past performance - According to this method, selling and distribution overheads are compared with the figures of the previous period. Alternatively, the expenses may be expressed as a percentage of sales, and the percentages may be compared with those of the past period. This method is suitable for small concerns.

- Budgetary Control - A budget is set up for selling and distribution expenses. The expenses are classified into fixed and variable. If necessary, a flexible budget may be prepared indicating the expenses at different levels of sales. The actual expenses are compared with the budgeted figures and in the case of variances suitable actions are taken.

- Standard Costing - Under this method standards are set up in relation to the standard sales volume. Standards may be set up for salesmen, territories, products etc. Once the standards are set up, comparison is made between the actuals and standards: variances are enquired into and suitable action taken.

10. CONCEPTS RELATED TO CAPACITY

(i) Installed/ Rated capacity: It refers to the maximum capacity of producing goods or providing services. Installed capacity is determined either on the basis of technical specification or through a technical evaluation. It is also known as theoretical capacity and is could not be achieved in normal operating circumstances.

(ii) Practical capacity: It is defined as actually utilised capacity of a plant. It is also known as operating capacity. This capacity takes into account loss of time due to repairs, maintenance, minor breakdown, idle time, set up time, normal delays, Sundays and holidays, stock taking etc. Generally, practical capacity is taken between 80 to 90% of the rated capacity. It is also used as a base for determining overhead rates. Practical capacity is also called net capacity or available capacity.

(iii) Normal capacity: Normal capacity is the volume of production or services achieved or achievable on an average over a period under normal circumstances taking into account the reduction in capacity resulting from planned maintenance.

Normal capacity is determined as under:

(iv) Actual capacity: It is the capacity actually achieved during a given period. It is presented as a percentage of installed capacity.

(v) Idle capacity: It is that part of the capacity of a plant, machine or equipment which cannot be effectively utilised in production.

- Normal Idle Capacity: It is the difference between Installed capacity and Normal capacity.

- Abnormal Idle Capacity: It is the difference between Normal capacity and Actual capacity utilization where the actual capacity is lower than the normal capacity.

The idle capacity may arise due to lack of product demand, non-availability of raw material, shortage of skilled labour, absenteeism, shortage of power fuel or supplies, seasonal nature of product etc.

Treatment of Idle capacity costs: Idle capacity costs can be treated in product costing, in the following ways:

- If the idle capacity cost is due to unavoidable reasons such as repairs, maintenance, changeover of job etc. a supplementary overhead rate may be used to recover the idle capacity cost. In this case, the costs are charged to the production capacity utilised.

- If the idle capacity cost is due to avoidable reasons such as faulty planning, power failure etc.; the cost should be charged to costing profit and loss account.

- If the idle capacity cost is due to seasonal factors, then, the cost should be charged to the cost of production by inflating overhead rates.

11. TREATMENT OF CERTAIN ITEMS IN COSTING

(i) Interest and financing charges: It includes any payment in nature of interest for use of non- equity funds and incidental cost that an entity incurs in arranging those funds. Example of interest and financing charges are interest on borrowings, financing charges in respect of finance leases, cash discount allowed to customers. The term interest and financing charges, finance costs and borrowing costs are used interchangeably. It does not include imputed costs.

Interest and financing charges shall be presented in the cost statement as a separate item of cost of sales.

(ii) Depreciation: Depreciation “is the diminution in the intrinsic value of an asset due to use and/or the lapse of time.” Depreciation is thus the result of two factors viz., the use, and the lapse of time. We know that each fixed asset loses its intrinsic value due to their continuous use and as such the greater the use the higher is the amount of depreciation. The loss in the intrinsic value may also arise even if the asset in question is not in service.

Assignment of Depreciation:

It shall be traced to the cost object to the extent economically feasible. Where it is not directly traceable it should be assigned using either or two principles i.e. (i) Cause and Effect and (ii) Benefit received.

(iii) Packing expenses: Cost of primary packing necessary for protecting the product or for convenient handling, should become a part of the production cost. The cost of packing to facilitate the transportation of the product from the factory to the customer should become a part of the distribution cost. If the cost of special packing is at the request of the customer, the same should be charged to the specific work order or the job. The cost of fancy packing necessary to attract customers is an advertising expenditure. Hence, it is to be treated as a selling overhead.

(iv) Fringe benefits: These are the additional payments or facilities provided to the workers apart from their salary and direct cost-allowances like house rent, dearness and city compensatory allowances. These benefits are given in the form of overtime, extra shift duty allowance, holiday pay, pension facilities etc.

These indirect benefits stand to improve the morale, loyalty and stability of employees towards the organisation. If the amount of fringe benefit is considerably large, it may be recovered as direct charge by means of a supplementary wage or labour rate; otherwise these may be collected as part of production overheads.

(v) Expenses on removal and re-erection of machines: Expenses are sometime incurred on removal and re-erection of machinery in factories. Such expenses may be incurred due to factors like change in the method of production; an addition or alteration in the factory building, change in the flow of production, etc. All such expenses are treated as production overheads. When amount of such expenses is large, it may be spread over a period of time.

If such expenses are incurred due to faulty planning or some other abnormal factor, then they may be charged to costing Profit and Loss Account.

(vi) Bad debts: There is no unanimity among different authors of Cost Accounting about the treatment of bad debts. One view is that ‘bad debts’ should be excluded from cost. According to this view bad debts are financial losses and therefore, they should not be included in the cost of a particular job or product.

According to another view it should form part of selling and distribution overheads, especially when they arise in the normal course of trading. Therefore bad debts should be treated in cost accounting in the same way as any other selling and distribution cost. However extra ordinarily large bad debts should not be included in cost accounts.

(vii) Training expenses: Training is an essential input for industrial workers. Training expenses in fact includes wages of workers, costs incurred in running training department, loss arising from the initial lower production, extra spoilage etc. Training expenses of factory workers are treated as part of the cost of production. The training expenses of office; sales or distribution workers should be treated as office; sales or distribution overhead as the case may be. These expenses can be spread over various departments of the concern on the basis of the number of workers on roll.

Training expenses would be abnormally high in the case of high labour turnover such expenses should be excluded from costs and charged to the costing profit and loss account.

(viii) Canteen expenses: The subsidy provided or expenses borne by the firm in running the canteen should be regarded as a production overhead. If the canteen is meant only for factory workers therefore this expenses should be apportioned on the basis of the number of workers employed in each department. If office workers also take advantage of the canteen facility, a suitable share of the expenses should be treated as office overhead.

(ix) Carriage and cartage expenses: It includes the expenses incurred on the movement (inward and outwards) and transportation of materials and goods. Transportation expenses related to direct material may be included in the cost of direct material and those relating to indirect material (stores) may be treated as factory overheads. Expenses related to the transportation of finished goods may be treated as distribution overhead.

(x) Expenses for welfare activities: All expenses incurred on the welfare activities of employees in a company are part of general overheads. Such expenses should be apportioned between factory, office, selling and distribution overheads on the basis of number of persons involved.

(xi) Night shift allowance: Workers in the factories, which operate during night time are paid some extra amount known as ‘night shift allowance’. This extra amount is generally incurred due to the general pressure of work beyond normal capacity level and is treated as production overhead and recovered as such.

If this allowance is treated as part of direct wages, the jobs/production carried at night will be costlier than jobs/production performed during the day. However, if additional expenditure on night shift is incurred to meet some specific customer order, such expenditure may be charged directly to the order concerned. If night shifts are run due to abnormal circumstances, the additional expenditure should be charged to the costing profit and loss account.

(xii) Research and Development Expenses: The Terminology defines research expenses as “the expenses of searching for new or improved products, new application of materials, or new or improved methods.” Similarly, development expenses are defined as “the expenses of the process which begins with the implementation of the decision to produce a new or improved product.”

If research is conducted in the methods of production, the research expenses should be charged to the production overhead; while the expenditure becomes a part of the administration overhead if research relates to administration. Similarly, market research expenses are charged to the selling and distribution overhead.

Development costs incurred in connection with a particular product should be charged directly to that product. Such expenses are usually treated as “deferred revenue expenses,” and recovered as a cost per unit of the product when production is fully established.

General research expenses of a routine nature incurred on new or improved methods of manufacture or the improvement of the existing products should be charged to the general overhead.

Even in this case, if the amount involved is substantial it may be treated as a deferred revenue expenditure, and spread over the period during which the benefit would accrue. Expenses on fundamental research, not relating to any specific product, are treated as a part of the administration overhead. Where research proves a failure, the cost associated with it should be excluded from costs and charged to the costing Profit and Loss Account.