SERVICE COSTING

Table of content

1. INTRODUCTION

Service sector, being a fastest growing sector and having a significant contribution towards the GDP in India, is a very important sector where the role of the cost and management accounting is inevitable. The competitiveness of a service entity is very much dependent on a robust cost and management accounting system for competitive pricing and identification of value adding activities. Providers of services like transportation, hotels, financial services & banking, insurance, electricity generation, transmission and distribution etc. are very much cost conscious and thrive to provide services in a cost-effective manner. Irrespective of regulatory requirements to maintain cost records and get the records audited, service costing becomes integral and inseparable part of each service entity. In this chapter we will be discussing how costing is done in service sectors like Transportation, Toll roads, Electricity generation, transmission and distribution, Hospitals, Canteen & Restaurants, Hotels & Lodges, Educational institutes, Financial institutions, Insurance, Information Technology (IT) & Information Technology Enabled Services (ITES) etc.

Service costing is also known as operating costing.

Application of Service Costing:

Internal: The service costing is required for in-house services provided by a service cost centre to other responsibility centres as support services. Examples of support services are Canteen and hospital for staff, Boiler house for supplying steam to production departments, Captive Power generation unit, operation of fleet of vehicles for transport of raw material to factory or distribution of finished goods to the market outlets, IT department services used by other departments, research & development, quality assurance, laboratory etc.

External: When services are offered to outside customers as a profit centre in consonance with organisational objectives as an output like goods or passenger transport service provided by a transporter, hospitality services provided by a hotel, provision of services by financial institutions, insurance and IT companies etc.

In both the situation, all costs incurred are collected, accumulated for a certain period or volume, recorded in the cost accounting system and then expressed in terms of a cost unit of service.

Service Costing versus Product Costing:

Service costing differs from product costing (such as job or process costing) in the following ways due to some basic and peculiar nature.

- Unlike products, services are intangible and cannot be stored, hence, there is no inventory for the services.

- Use of Composite cost units for cost measurement and to express the volume of outputs.

- Unlike a product manufacturing, employee (labour) cost constitutes a major cost element than material cost.

- Indirect costs like administration overheads are generally have a significant proportion in total cost of a service as unlike manufacturing sector, service sector heavily depends on support services and traceability of costs to a service may not economically feasible.

2. SERVICE COST UNIT

To compute the Service cost, it is necessary to understand the unit for which the cost is to be computed. All the costs incurred during a period are collected and analyzed and then expressed in terms of a cost per unit of service.

One specific issue with service costing is the difficulty in defining a realistic cost unit that represents a suitable measure of the service provided. The cost unit to be applied needs to be defined carefully and frequently, a composite cost unit may be deemed more appropriate.

For example, Hotels may use the ‘Occupied Room Days’ as an appropriate unit for cost ascertainment and control.

Other typical cost unit that may be used include:

| Service Industry |

Unit of cost (examples) |

| Transsport Services |

Passenger - km., (In public transportation)

Quintal - km., or Ton - km. (In goods carriage) |

| Electricty Supply Service |

Kilowatt - hour (kWh) |

| Hospital |

Patient per day, room per day or per bed, per operation etc. |

| Canteen |

Per item, per meal etc. |

| Cinema |

Per ticket |

| Hotels |

Guest Day or Room Days |

| Bank or Financial Insttitutions |

Per transaction, per services (e.g. per letter of credit, per application, per project etc.) |

| Educational Institutes |

Per course, per student, per batch, per lecture etc. |

| IT & ITES |

Cost per project, per module etc. |

| Insurance |

Per policy, per claim, Per TPA etc. |

The costing should be comprehensive enough to show the effects like off-season and peak-season demand, full time, part time, etc.

Methods for ascertaining Service Cost Unit:

Composite Cost Unit:

Sometime two measurement units are combined together to know the cost of

service or operation. These are called composite cost units. For example, a public transportation undertaking would measure the operating cost per passenger per kilometre.

Examples of Composite units are Ton- km., Quintal- km, Passenger-km., Patient- day etc. Composite unit may be computed in two ways.

- Absolute (Weighted Average) basis.

- Commercial (Simple Average) basis.

In both bases of computation of service cost unit, weightage is also given to qualitative factors rather quantitative (which are directly related with variable cost elements) factors alone.

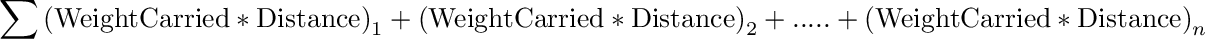

(i) Weighted Average or Absolute basis –It is summation of the products of qualitative and quantitative factors. For example, to calculate absolute Ton-Km for a goods transport is calculated as follows.:

Similarly, in case of Cinema theatres, price for various classes of seats are fixed differently. For example–

First class seat may be provided with higher quality service and hence charged at a higher rate, whereas Second Class seat may be priced less. In this case, appropriate weight to be given effect for First Class seat and Second Class seat – to ensure proper cost per composite unit.

(ii) Simple Average or Commercial basis – It is the product of average qualitative and total quantitative factors. For example, in case of goods transport, Commercial Ton-Km is arrived at by multiplying total distance km., by average load quantity.

In both the example, variable cost is dependent of distance and is a quantitative factor. Since, the weight carried does not affect the variable cost hence and is a qualitative factor.

To understand the concept of absolute ton-km., and commercial ton-km., the following illustration may be referred.

Equivalent Cost Unit/ Equivalent service Unit:

To calculate cost or pricing of two more different grade of services which uses common resources, each grade of service is assigned a weight and converted into equivalent units. Converting services into equivalent units make different grade of services equivalent and comparable.

For Example:

A hotel has three types of suites for its customers, viz., Standard, Deluxe and Luxurious

Following information is given:

| Type of suite |

Number of rooms |

Room Tariff |

| Standard |

100 |

- |

| Deluxe |

50 |

2.5 times of the Standard suits |

| Luxurious |

30 |

Twice of the Deluxe suits |

The rent of Deluxe suite is to be fixed at 2.5 times of the Standard suite and that of Luxurious suite as twice of the Deluxe suite.

Since, all three types of suits use same amount of overheads but to attach qualitative weight, these rooms are required to be converted into equivalent units.

This can be done in two ways

(i) Making all suits equivalent to Standard suits:

| Nature of suite |

Occupancy (Room-days) |

Equivalent single room suites (Room-days) |

| Standard |

36,000

(100 rooms x 360 days) |

36,000

(36,000 x 1) |

| Deluxe |

18,000

(50 rooms x 360 days) |

45,000

(18,000 x 2.5) |

| Luxurious |

10,800

(30 rooms x 360 days) |

54,000

(10,800 x 5) |

| |

|

1,35,000 |

(ii) Making all suits equivalent to Luxurious suits:

| Nature of suite |

Occupancy (Room-days) |

Equivalent Luxurious suites (Room-days) |

| Standard |

36,000

(100 rooms x 360 days) |

7,200

(36,000 x 1/5) |

| Deluxe |

18,000

(20 rooms x 360 days) |

9,000

(18,000 x 1/2) |

| Luxurious |

10,800

(30 rooms x 360 days) |

10,800

(10,800 x 1) |

| |

|

27,000 |

3. STATEMENT OF COSTS FOR SERVICE SECTORS

For preparing a statement of cost or a cost sheet for service sector, costs are usually collected and accumulated for a specified period viz. A month, quarter or a year, etc.

The cost statement for services may be prepared either on the basis of functional classification as done for product costing or on the basis of variability. Cost sheet on the basis of variability is prepared classifying all the costs into three different heads:

- Fixed costs or Standing charges

- Variable costs or Operating expenses

- Semi-variable costs or Maintenance expenses

Note: In the absence of information about semi-variable costs, the costs would be shown under fixed and variable heads only.

Treatment of Depreciation- fixed or variable?

If related to effluxion of time or calculated on time basis, will be treated as fixed. However, if the depreciation is calculated on the basis of activity level or usage, it will be treated as variable cost.

Treatment of Interest:

Interest and finance charges shall be presented in the cost statement as a separate item of cost of sales. In general, interest is treated as fixed cost, unless otherwise given.

4. COSTING OF TRANSPORT SERVICES

Transport organizations can be divided into two categories viz. Goods transport and Passenger transport.

The cost unit for Goods transport organization is Ton– Kilometer – that means cost of carrying one Ton of goods over a distance of one kilometer.

Cost unit for Passenger transport organization is Passenger– Kilometer – that means cost of carrying one Passenger over a distance of one kilometer.

The costs are shown under the suggestive following heads:

(i) Standing Charges or Fixed costs: These are the fixed costs that remain constant irrespective of the distance travelled. These costs include the following:

- Insurance

- License fees

- Salary to Driver, Conductor, Cleaners, etc if paid on monthly basis

- Garage costs, including garage rent

- Depreciation (if related to efflux of time)

- Taxes

- Administration expenses, etc.

(ii) Variable costs or Running costs: These costs are generally associated with the distance travelled. These costs include the following:

- Petrol and Diesel

- Lubricant oils,

- Wages to Driver, Conductor, Cleaners, etc. if it is related to operations

- Depreciation (if related to activity)

- Any other variable costs identified.

(iii) Semi-variable costs or Maintenance costs: These costs include the following:

- Repairs and maintenance

- Tyres

- Spares, etc.

The heads for a cost may change as per the situation or condition. For an example salary of driver may be treated as standing charges or running cost depending on the situation and nature of his employment.

5. COSTING OF HOTELS AND LODGES

Service costing is an effective tool in respect if hotel industry. Hotels are run on commercial basis. Hence it is necessary to compute the cost - to fix the price of various services provided by the hotel and to find out the profit or loss at the end of a particular period.

In this case, the costs associated with different services offered should be identified and cost per unit should be worked out. The cost unit may be Guest-day or Room day. For calculation of cost per Guest day or Room day, estimated occupancy rate – at different point of time, for example – Peak season or lien season, are taken in to account.

6. COSTING OF HOSPITALS

A Hospital is providing various types of medical services to the patients. Hospital costing is applied to decide the cost of these services.

A hospital may have different departments catering to varied services to the patients – such as

- Out Patient

- In Patient

- Medical services like X-Ray, Scanning, etc.

- General services like Catering, Laundry, Power house, etc.

- Miscellaneous services like Transport, Dispensary, etc.

Unit of Cost

Common unit of costs of various departments are as follows:

- Out Patient – Per Out-patient

- In Patient – Per Room Day

- Scanning – Per Case

- Laundry – Per 100 items laundered

Cost segregation

The cost of hospital can be divided in to fixed costs and variable costs

Fixed costs are based on timelines and irrespective of services provided. For example, Staff salaries, Depreciation on Building and Equipment, etc.

Variable costs vary with the level of services rendered. For example, Laundry charges, Cost of food supplied to patients, Power, etc.

7. COSTING OF IT & ITES

Information Technology (IT) and Information Technology Enabled Services (ITES) organizations provide their customers with services or intangible products. These organizations are highly labour intensive.

The services of IT and ITES organizations may be used for – provision of services to outside customers or provision of services internally (captive consumption)

In this sector employee (labour) cost constitutes a significant portion of the total operating costs. The direct employee cost is traceable to services rendered.

In addition to employee cost, significant overhead costs for offering the services are incurred and are classified as service overhead. To arrive at the cost incurred for rendering the services, it is necessary to allocate / apportion such overheads to cost units.

Concept of Project

In general – IT & ITES industries, the jobs undertaken are considered as Project. Each project is unique in nature and varies in size, functionality requirements, duration and staffing requirements.

When a project is taken up, a detailed planning is done – by breaking down the project into number of activities and their dependencies. Based on the above, project scheduling are developed.

Then the skill level requirement for carrying out each of the activities is identified and the duration of each and every activity would be ascertained. This process is known as effort estimation.

Once the skill level and duration is identified, then required man-power is identified for carrying out the activities.

Normally, project scheduling and effort estimation is carried out together. The costs of development are primarily the costs of the effort involved, so the effort computation is used in both the cost and the schedule estimate

Effort involved

Direct Manpower

In a typical software implementation project, three to four levels of man-power would be directly engaged, as mentioned below: -

- Software Engineers / Functional Consultants / Business Analysts

- Project Leaders

- Project Manager

- Program Manager, etc

Depending on the nature and complexities of the projects being implemented, the number of persons engaged, their levels and duration of the engagement varies. For example, in a multi-continental, multi-time zone software implementation projects, in addition to the above man-power, Customer Account Manager, Portfolio Manager, etc may be involved.

The costs incurred on the above listed man-power are traceable with a project and hence forming part of direct costs of the project.

Support Man-power

In addition to the above persons, who are directly engaged in project, there could be support persons or indirect manpower, who are indirectly involved in the project.

For example, Quality Assurance Team, Testing team, Version Control team, Staffing Manager, etc who are indirectly support the projects by providing required level of support services over the life of the projects.

It is possible that the indirect manpower may be involved in more than one project, simultaneously. Their time spent, may or may not be traced on any particular project and will be used across multiple projects.

If their time can be identified with a project, they will be treated as direct manpower. Accordingly, the cost incurred on them will be treated as direct cost.

However, if their time is not traceable with a single project, then it may either be allocated or apportioned to various projects on some suitable basis. Accordingly, the cost incurred on them will be treated as overhead and the same will be apportioned to various projects on some suitable basis.

Effort Cost in these types of organizations are calculated on the basis of cost per Person day or cost per Person week or cost per Person month. That means cost incurred for a person for rendering services per day or per week or per month.

Depending on the requirement of the customer, the periodicity will be defined. For example, implementation of new software may require eight to twelve person months. In such a case, the cost will be calculated on Per Person month basis. On the other hand, implementation of one or two new functionality in already implemented (existing) software may require one or two week’s efforts. In such a case, the cost will be calculated on per Person week basis.

Parameters in computation of total cost

A. Hardware and software costs involved

- If they are identifiable with a project, then they are directly allocated to the project

- If they are not directly identifiable with a project or not fully allocable to a project, then they are treated as service overhead

B. Travel and training costs

- If they are incurred for a project, then they are directly allocated to the project

- If they are not directly identifiable with a project or allocable over a number of projects, then they are treated as service overhead. For example, Java (software language) training provided to the software engineers, may useful in multiple Java based projects. Hence treated as overhead costs

C. Effort costs

- - Effort costs are basically identified with a project. They can be classified as direct cost, unless otherwise specified.

- - Effort costs are not just the salaries of the software engineers or programmers who are involved in the project. Organisations compute effort costs in terms of overhead costs where they take the total cost of running the organisation and divide this by the number of productive staff. Therefore, the following costs are all part of the total effort cost:

- Costs of providing, heating and lighting office space

- Costs of support staff such as accountants, administrators, system managers, cleaners and technicians

- Costs of networking and communications

- Costs of central facilities such as a library or recreational facilities

- Costs of Social Security and employee benefits such as pensions and health insurance, etc.

In short, effort cost includes Salary of the staff concerned and part of common overhead.

8. COSTING OF TOLL ROADS

The Construction of roads brings about a variety of benefits that are enjoyed practically by all sectors of the economy. Highway economic analysis is a technique whereby the cost and benefit from a scheme are quantified over a selected time horizon and evaluated by a common yardstick.

The economic analysis involves comparison of project costs and benefits under the "with" and "without" project conditions.

The project is further subjected to sensitivity analysis by assessing the effects of adverse changes in the key variables. In addition, the combined effect of these changes is also assessed. This helps to gauge the economic strength of the project to withstand future risks and uncertainties.

Cost Involved

The project cost consists of following two main components:

Capital Costs

The capital cost consists of cost incurred during the construction period. Generally, this sort of road construction projects run across multiple financial years. The total expenditure to be incurred during the construction period is termed as capital cost.

The total cost includes the cost of construction of road and other structures and consultancy charges. In addition to this cost, it also includes the cost of construction of tollbooths.

Construction expenses can be broadly classified as follows:

- Preliminary and pre-operative expenses

- Land Acquisition

- Materials

- Labour

- Overheads incurred in the course of actual construction

- Contingency allowance

- Interest during construction period

Operating and Maintenance Costs

Routine maintenance cost would be incurred once the Toll road is operational. Routine maintenance involves Patching of potholes, sealing of cracks, Edge Repair, Surface Renewal, Periodic maintenance for new highways would be met with in accordance with the analysis of the life cycle model carried out for the project.

Annual operating cost includes the cost of operating tollbooths, administrative expenses, emergency services, communications and security services and other costs of operation.

Maintenance cost includes the cost of annual maintenance (routine) and periodic maintenance.

- Annual maintenance cost includes primary maintenance of wearing surface, railings, roadside furniture, etc.

- Periodic maintenance cost includes the cost of overlays (wearing coats), painting of railings, etc.

Operating and Maintenance expenses can be broadly classified as follows:

- Toll collection expenses

- Administrative expenses for day-to-day operation.

- Maintenance expenses, which include routing and periodic maintenance.

- Interest expenses incurred for servicing term loans.

Build-Operate-Transfer (BOT) Approach

In recent years a growing trend emerged among Governments in many countries to solicit investments for public projects from the private sector under BOT scheme. BOT is an option for the Government to outsource public projects to the private sector.

With BOT, the private sector designs, finances, constructs and operate the facility and eventually, after specified concession period, the ownership is transferred to the Government. Therefore, BOT can be seen as a developing technique for infrastructure projects by making them amenable to private sector participation.

The fundamental principle in determining user levy is, 'if the price for a transport facility is set at a level that reflects the benefit, each user gains from improvements in the facility, it will result in traffic flow levels that equate social costs with user benefits.'

Toll Rate

In general, the toll rate should have a direct relation with the benefits that the road users would gain from its improvements. The benefits to road users are likely to be in terms of fuel savings, improvement in travel time and Good riding quality.

To compute the toll rate following formula with rounding off to nearest multiple of five has been adopted:

User Fee = Total Distance × Toll Rate per km

9. COSTING OF EDUCATIONAL INSTITUTIONS

Educational institutions like schools, colleges, technical institutes for education and training, are run to impart education and training to students. The objective of running these institutions may be ‘Not-for profit’ or ‘For profit’. Like other business entities, cost and management accounting is also inevitable for this sector. The Government, Local body of any other organisation which provides education and training to students with an objective to benefit and upliftment of the society, are also need cost and management accounting system for cost-social benefit analysis, allocation of funds and budgeting (zero-based budgeting), performance measurement and evaluation etc.

Income of the Educational Institutions

The source of income of an institute may be classified on the basis of recurrence as follows:

One-time fees: These are the fees which are collected once in a course period or for a definite period like Admission fee, Development fee, Annual fee etc.

Recurring fees: Tuition fee, laboratory, computer and internet fee, library fee, training fee, amenities fee, sports fee, extracurricular activities fee etc.

The Government and other aided institutes may not be permitted to collect various fees like capitation fee and development fees etc. Further, unlike the trading and manufacturing organizations, these are not free to determine fees beyond a prescribed limit.

Other incomes: The indirect income like transport, hostel, mess and canteen for the students and staff are provided by the educational institutions normally on no profit no loss basis.

Expenditure of the Educational Institutions

(i) Operational Cost:

Following are the major operational costs incurred by an educational institution:

- The salary of the teaching and non-teaching staff

- Laboratory maintenance charges

- Computer maintenance and internet charges,

- Building maintenance,

- Repairs and maintenance of equipment,

- Administrative expenses,

- Finance charges etc.

Cost Centres and basis of cost allocation

Cost centres in educational institutions are classified as follows:

- Primary or Direct cost centres (like Civil Engineering department, Mechanical Engineering department, etc.)

- Service cost centres (like Laboratory, Library, Sports, etc.)

- Student’s Self-Supporting Services (like Transport, Hostel & Mess, etc.)

- Administration Cost centres (like Research & Improvement, Examination)

Costs incurred are allocated to the respective cost centres, if they are identifiable with a cost centre and apportioned to service and administration cost centres on suitable basis.

(ii) Research and Development Cost

Educational institutions undertake academic research on various fields of specialisations. The costs of such research including personal costs, books etc. are to be collected through a cost centre approach. All costs incurred in that cost centre are collected and set off against the revenue generated from such research projects.

If any balance is left out as undistributed, then such balance costs can be collectively distributed to all other course cost centre as a separate cost element namely “Research costs“.

(iii) Cost of Publication of research and other materials

In an educational institution, there will be a separate department for conducting research publication related exercise. The cost incurred would be directly allocated to that department.

10. COSTING IN INSURANCE COMPANIES

Insurance or assurance industry operates in providing social security to the persons who subscribe for the policy. The Insurance companies are broadly classified as Life insurer and Non-Life Insurer (General Insurance providers). Life insurers provide assurance to the policy holders’ life for the insured value. The Non-life insurers are providing insurance to the policyholder for actual loss upto insured value for the policy.

The insurance companies are need to analyse it various insurance product for profitability. The product offered by insurance companies may include:

- Life Insurance policies- with or without maturity benefits

- General insurance- Health, Fire, Property, Travel Insurance etc.

- Others services- Re-insurance, Fund management- Pension, Gratuity and other etc.

Income of Insurance companies

Income of insurance companies may include

- Premium on policy (periodic or onetime)

- Commission on re-insurance

- Fund administration fee and return on investment of funds etc.

Expenditure of Insurance companies

The Expenditure of an insurance company can be classified as direct and indirect to a policy or product.

Direct- Commission paid to agents, claim settlement, cost of valuation, premium for re-insurance, legal and other costs etc.

Indirect Cost- Actuarial fees, market and product development costs, administration cost, asset management cost etc.

Method of Costing in an Insurance Company

The cost object in an insurance company may be a product, a policy, a department or region, an agent etc.

Activity Based Costing in Insurance Companies

Activity based costing (ABC) is used for analysis of cost-benefit of a product (Direct Product Profitability), policy profitability (Customer Profitability Analysis) etc.

Costs that occur in insurance companies are to be identified with appropriate activities that have caused its occurrence. Then costs must be reassigned from activities to cost objects (insurance contracts and policies, customers, delivery channels) based on identified cost drivers.

Identification of activities and assignment of costs are the most critical for the implementation of activity based costing. The activities can be divided into two part

i.e.

- Pre-product development activities: These are the activities which are carried out before a product is made. It includes market research, product development like specification of coverage, conditions, amount of premium, insurance contract, policy forms and provision for sales channel etc.

- Post product development activities: This activity is further divided into parts i.e. (a) Selling of policy and (b) Processing of claims. (a) Selling of policy refers to appointment of distribution of sales channel (direct selling or through agencies), soliciting for policy, processing of applications etc. (b) Processing of claim includes claim inception, claim estimation, claim settlement and legal actions.

The activities costs are assigned to the products on the basis of appropriate cost drivers. The cost drivers may include no. of hours spent on processing of an application and claim processing, no. of application, no. of policy, no. of claim etc.

11. COSTING IN FINANCIAL INSTITUTIONS

In the past two decade financial institutions have undergone major changes – in terms to increased regulations, competition from new entrants from both locally and globally, innovation of new products and services, technological advancement and increased expectations of new generation customers, etc.

Over and above the challenges posed by the prevailing environment as described above, financial institutions underwent considerable changes in terms of its high quality, sensitive staffing requirements and its productivity.

Manpower cost, other than interest cost and finance charges, is one of the largest single cost components in financial institutions. Hence, it is needless to say, that financial institutions are more interested in understanding and discovering the ways to more accurately allocate such costs to various product ranges offered by them and its customers.

If the financial institution is to survive under the present challenging economic conditions, it will have to add value to its products and services. It is imperative to note that the financial institution needs to know the contribution of its products, services and customers to value creation.

Cost measurement in financial institutions

The objectives of cost measurement includes –

- Understand the profitability by products offered and by customers

- Establishing a mechanism for pricing the products, by identifying the product level and activity level unit costs

- Understanding productivity issues and their relationship with strategic goals of the organization

In nutshell, financial institutions need to understand their position in various product lines and to find out how they can stay in competing edge or becomes a leader.

Activity Based Costing in Financial Institutions

Activity based costing can be a useful tool in allocating the cost elements to various products offered and the customers being serviced.

Activity based costing can help financial institutions to –

- Identify and analyze the profitability by product

- Analyze the profitability by customer

- Identify the activity level unit costs and build up product level costs, which in turn forms basis for product level pricing / customer level pricing

Financial institutions can improve their profitability by –

- Concentrating on products that are more profitable

- Focus on high margin customers

Costs that occur in financial institutions are to be identified with appropriate activities that have caused its occurrence. Then costs must be reassigned from activities to cost objects (various loan products offered by the organization, customers, etc.) based on identified cost drivers.

The concepts on activity based costing as discussed under Costing of Insurance Companies also applicable to financial institutions. Please refer the same.

12. OTHER SERVICES- COSTING FOR POWER HOUSES

Power houses are engaged either in electricity generation or steam generation use the concepts of service costing i.e. ‘Power House Costing.’ Service cost statement can be prepared by identifying the costs associated with the power generation or steam generation.

Cost unit is different for electricity generation and steam generation.

The cost unit for electricity generation organization is cost per kilowatt-hour (kWh) – that means cost of generating one kilowatt of power per hour. Please note that kWh is commonly known as a “Unit”.

The costs are shown under the following heads:

(i) Standing Charges or Fixed costs: These are the fixed costs that remain constant irrespective of the power or stream generated. These costs include the following:

- Rent, Rates & Taxes

- Insurance

- Depreciation

- Salaries, if paid on Time (Monthly) basis

- Administration expenses, etc.

(ii) Variable costs or Running costs: These costs are generally associated with the power or stream generated. These costs include the following:

- Fuel Charges

- Water Charges

- Wages / Labour charges, if paid on the basis of production

- Any other variable costs identified.

(iii) Semi-variable costs or Maintenance costs: These costs include the following:

-

Meters

-

Furnaces

-

Service materials

-

Tools, etc.