STANDARD COSTING

Table of content

1. INTRODUCTION

Cost control is one of the objectives of cost management. Management of an organisation setups predetermined cost to compare the actual cost with the predetermined cost. Predetermined costs are standardcosts used for cost control and performance evaluation. Standard costing is a method of cost and management accounting which starts with setting of standards and ends with reporting of variances to management for taking corrective actions. The Official Terminology of CIMA, London defines standard costing as “Control technique that reports variances by comparing actual costs to pre-set standards so facilitating action through management by exception.”

What is a Standard or Standard Cost?

Standard cost is defined in the CIMA Official Terminology as “'the planned unit cost of the product, component or service produced in a period. The standard cost may be determined on a number of bases. The main use of standard costs is in performance measurement, control, stock valuation and in the establishment of selling prices.” From the above definition Standard costs can be said as

- Planned cost

- Determined on a base or number of bases.

Why Standard Costing is Needed?

Standards or Standard costs are established to evaluate performance of a responsibility centre. Apart from performance evaluation and cost control, standard costs are also used to value inventory where actual figures are not reliably available and to determine selling prices particularly while preparing quotations.

Standard costing system is widely accepted as it serves different needs of an organisation. The standard costing is preferred for the following reasons:

- Prediction of future cost for decision making: Standard costs are set after taking all present conditions and future possibilities into consideration. Hence, standard cost is future cost for the purpose of cost estimation and profitability from a proposed project/ order/ activity.

- Provide target to be achieved: Standard costs are the target cost which should not be crossed by the responsibility centres. Performance of a responsibility centre is continuously monitored and measured against the set standards. Any variance from the standard is noted and reported for appropriate action.

- Used in budgeting and performance evaluation: Standard costs are used to set budgets and based on these budgets managerial performance is evaluated. This is of two benefits, one managers of a responsibility centre will not compromise with the quality to fulfill the budgeted quantity and second, variances can be traced with the responsible department or person.

- Interim profit measurement and inventory valuation: Actual profit can only be known after the closure of the accounts. But an organisation may need to prepare profitability statement for interim periods for managerial reporting and decision making. To arrive at profit figure, standard costs are deducted from the revenue.

2. TYPES OF STANDARDS

Types of standards are as below:

(i) Ideal Standards: These represent the level of performance attainable when prices for material and labour are most favourable, when the highest output is achieved with the best equipment and layout and when the maximum efficiency in utilisation of resources results in maximum output with minimum cost.

These types of standards are criticised on three grounds:

- Since such standards would be unattainable, no one would take these seriously.

- The variances disclosed would be variances from the ideal standards. These would not, therefore, indicate the extent to which they could have been reasonably and practically avoided.

- There would be no logical method of disposing of these variances.

(ii) Normal Standards: These are standards that may be achieved under normal operating conditions. The normal activity has been defined as “the number of standard hours which will produce at normal efficiency sufficient good to meet the average sales demand over a term of years”.

These standards are, however, difficult to set because they require a degree of forecasting. The variances thrown out under this system are deviations from normal efficiency, normal sales volume, or normal production volume.

If the actual performance is found to be abnormal, large variances may result and necessitate revision of standards.

(iii) Basic or Bogey Standards: These standards are used only when they are likely to remain constant or unaltered over a long period. According to this standard, a base year is chosen for comparison purposes in the same way as statisticians use price indices. Since basic standards do not represent what should be attained in the present period, current standards should also be prepared if basic standards are used. Basic standards are, however, well suited to businesses having a small range of products and long production runs. Basic standards are set, on a long- term basis and are seldom revised. When basic standards are in use, variances are not calculated. Instead, the actual cost is expressed as a percentage of basic cost. The current cost is also similarly expressed and the two percentages are compared to find out how much the actual cost has deviated from the current standard. The percentages are next compared with those of the previous periods to establish the trend of actual and current standard from basic cost.

(iv) Current Standards: These standards reflect the management’s anticipation of what actual costs will be for the current period. These are the costs which the business will incur if the anticipated prices are paid for the goods and services and the usage corresponds to that believed to be necessary to produce the planned output.

The variances arising from expected standards represent the degree of efficiency in usage of the factors of production, variation in prices paid for materials and services and difference in the volume of production.

3. THE PROCESS OF STANDARD COSTING

The process of standard cost is as below:

- Setting of Standards: The first step is to set standards which are to be achieved, the process of standard setting is explained below.

- Ascertainment of actual costs: Actual cost for each component of cost is ascertained. Actual costs are ascertained from books of account, material invoices, wage sheet, charge slip etc.

- Comparison of actual cost with standard cost: Actual costs are compared with the standards costs and variances are determined.

- Investigate the reasons for variances: Variances arises are investigated for further action. Based on this, performance is evaluated and appropriate actions are taken.

- Disposition of variances: Variances arise are disposed-off by transferring it the relevant accounts (costing profit and loss account) as per the accounting method (plan) adopted.

4. SETTING UP OF STANDARD COST

Standard cost is set on the basis of management’s estimation. Cost is estimated on the basis of technical specification provided by the engineering department or other expert such as production engineer. Generally, while setting standards, consideration is given to historical data, current production plan and expected conditions of future. For the sake of detailed analysis and control, standard cost is set for each element of cost i.e. material, labour, variable overheads and fixed overheads. Standard are also set for the sales quantity and sales value; this is generally known as budgeted sales.

Standards are set in both quantity (units or hours) and in cost (price or rate). It is thus measure in quantities, hours and value of the factors of production.

Standard costs are divided into three main cost components, such as

- Direct Material Cost

- Direct Employee (Labour) Cost and

- Overheads

Standards are set in both physical and monetary terms for each cost components. Details are as follows:

Physical Standards

Physical standards refer to expression of standards in units or hours. At this stage standard quantity and standard hours are determined for a particular product or service. The purpose of setting standards is to secure economies in scale of production and to set selling price for quotation purpose.

In manufacturing organisations, the task of setting physical standards is assigned to the industrial engineering department. While setting standards consideration is given to :

- Company’s operating plan i.e. budgets

- Final output to be produced

- Material specification, in both quantity and quality provided by the engineering department.

- Proportion of material to be used in case of multiple inputs.

- Method of production i.e. fully automated, semi-automated or manual.

- Skill set of workers and availability of workers.

- Working conditions and internal factors.

- External factors (such as Labour Law, Factories Act, Govt. policy etc.).

PROCEDURE OF SETTING MATERIAL QUANTITY STANDARDS

The following procedure is usually followed for setting material quantity standards.

- Standardisation of products: At this phase, products to be produced are decided based on production plan and customer’s order. Generally following questions are answered at this stage: (i) What to be produced? (ii) Which type to be produced and (iii) How much to be produced?

- Product study: Product to be produced is analysed and studied for developments and production. Product study is carried out by the engineering department or product consultants. At this phase answers to the following questions are satisfied: (i) How can it be produced? (ii) What are the pre-requisites? (iii) Which type of materials to be used? (iv) How products can be accepted in the market? etc.

- Preparation of specification list: After the product study a list of material is prepared. It specifies types (quality) and quantity of materials to be used, substitute of the materials, quantity and proportion of materials to be used, process to be followed, pre-requisites and condition required etc. While preparing specification list consideration to expected amount of wastage is given. It must be customised to adopt changes in the product.

- Test runs: Sample or test runs under specified conditions are carried out and sample products are tested for the desired quality and quantity. Any deviation from the specification is noted down and specification list is updated.

PROCEDURE OF SETTING LABOUR TIME STANDARDS

The following are the steps involved in setting labour standards:

- Standardisation of product and product study is carried out as explained above.

- Labour specification: Types of labour and labour time is specified. Labour time specification is based on past records and it takes into account normal wastage of time.

- Standardisation of methods: Selection of proper machines to use proper sequence and method of operations.

- Manufacturing layout: A plan of operation for each product listing the operations to be performed is prepared.

- Time and motion study: It is conducted for selecting the best way of completing the job or motions to be performed by workers and the standard time which an average worker will take for each job. This also takes into account the learning efficiency and learning effect.

- Training and trial: Workers are trained to do the work and time spent at the time of trial run is noted down.

PROCEDURE OF SETTING OVERHEADS TIME/ QUANTITY STANDARDS

Variable overhead time/ quantity is estimated based on specification made by the engineering departments. Variable overheads may either be based on direct material quantity or labour hour. Generally, it is based on labour time worked.

Fixed overhead time is based on budgeted production volume.

Problems faced while setting physical standards

The problems involved while setting physical standards will vary from industry to industry and may be illustrated as under:

(a) A situation may arise where the company is introducing the manufacture of a new line of product. In such case, it may be necessary to employ workers who have no experience in the job. This creates a problem of setting standard time because it is necessary to make adjustment for the inexperience of workers.

(b) Changes in technology may necessitate installation of sophisticated machines. When such machines are installed, the precise estimation of output and standard of efficiency achievable will pose a problem until after a long time when the working conditions are settled. Thus, setting standards for these machines and estimating the standard costs will need considerable amount of work.

(c) Often manufacturers prefer to product diversification to improve profitability. One of the most important problems that arise with the proposed change in product is re-setting of production facilities. For example, when an old copper part is to be changed into one made of bronze to suit the new product, special care has to be taken to order new tools which in turn, pose the problem of setting up of standard time in respect of the new tools.

(d) Standards of material specifications are established and if the materials are not available as per specifications, the standards may not be achievable.

(e) Very often the cost accountant is confronted with the problem of choosing the type of standards to be adopted. For example, the industrial engineer has furnished the standard time for all direct labour operations as under:

- Standard time attainable by the best operations is 2 hours per unit of product including allowances for personal fatigue and delay.

- Attainable good performance for the average trained operator is 2.10 hours per unit of product.

- Average past performance is 2.60 hours per unit.

The problem is, should direct labour standard hour be based on maximum efficiency or attainable good performance or average past performance? If costs are to represent maximum efficiency, the unit cost used in selling price will relatively be low but a high debit variance may arise if the standard efficiency is not achieved.

If, however, the standard cost is based on attainable good performance, the variances may tend to be nil. If efficiency is to be gauged, maximum efficiency standard will reflect the off standard performance, thereby enabling the departmental head to exercise control.

Similar problems as those mentioned above, may also arise in setting of waste standards. For example, the question may arise as to whether only absolutely unavoidable wastage should be provided or the past average level of wastage may be provided. This will again have different impact on the standard cost of production.

Price or Rate Standards

Broadly, the price or rate standards can be set on either of the following bases:

- Actual average or mean price expected to prevail during the coming period, say one year; or

- Normal prices expected to prevail during a cycle of seasons which may be of a number of years.

PROCEDURES OF SETTING MATERIAL PRICE STANDARDS

Material prices are not altogether within the control of the manufacturer; but the purchasing department, on being apprised of production quantities required, should be able, from its knowledge of current market conditions and trends, to state with reasonable accuracy price for the constituent items. The standards for prices of materials should be based on the following factors, if price fluctuations are small and are not serious.

- Stock of materials on hand and the prices at which they are held;

- The prices at which orders for future deliveries of materials (agreement entered into) have already been placed,

- Minimum support price fixed by the appropriate authority and

- Anticipated fluctuation in price levels

In case there are unsystematic fluctuations in the market price, it may be difficult to determine standard costs of materials; fluctuations in the market price may be of different sorts; prices may be different from month to month, from one season to another or from one year to another. There may be a secular trend which, on the whole, is pushing price upwards or downwards. The nature of difficulties encountered in fixing standard costs of materials will naturally be different in each case. In addition, the purchasing policy of the company and the objective to be achieved (from cost accounting) will make a difference.

The difficulty in determining the standard cost of material in such a situation can be resolved as follows:

- In case prices fluctuate from month to month, the average of prices of a year corrected for the known secular changes and any other expected change can very well serve as the standard price for the next year.

- If the fluctuations are seasonal, but the whole year’s requirements are purchased at one time, the weighted average of the likely prices to be paid should be treated as the standard price. But, if buying is also spread over the whole year, the weighted average of the prices for the whole year should be the standard price.

- If prices fluctuate from one year to another, a careful estimate of the price likely to prevail next year, based on a statistical study, should be adopted as the standard price.

PROCEDURES OF SETTING WAGE RATE STANDARD

The type of labour required for performing a specific job would be the most important factor for deciding the rate of wage to be paid to workers. Standard wage rate for skilled and unskilled workers are set based on the following basis:

- Time taken by the workers to complete a unit of production.

- Time or piece rate prevailing in the industry. It can be known from the peers.

- Wage agreement entered into between the management and workers’ union.

- Law prevailing in the area of operation, law like Payment of minimum wages Act, Payment of bonus Act etc.

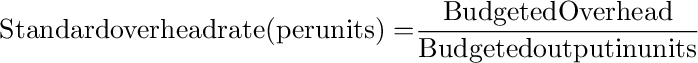

PROCEDURES OF SETTING OVERHEAD EXPENSE STANDARDS

In computing the overhead expense standards, consideration should be given to the level of output and the budgeted expenses. A budgeted output is fixed considering practical manufacturing capacity and anticipated sales demand. Expenditures can be budgeted under different heads for the level of output chosen. These expenditures are classified as fixed and variable. Thus, the overhead expense standards are set by computing the optimum level of output for a production departments followed by budgets for fixed and variable overheads. If production is seasonal or it fluctuates during the year, a flexible budget may be prepared to facilitate comparison between the set target and actual expenditure for the period.

5. TYPES OF VARIANCES

Controllable and un-controllable variances: For effective cost control it is necessary to investigate into the reasons for cost variances and to take corrective actions. For this purpose variances are classified as controllable and uncontrollable variances. Controllable variances are those which can be controlled under the normal operating conditions if a responsibility centre takes preventive measures and acts prudently. Uncontrollable variances are those which occurs due to conditions which are beyond the control of a responsibility centre and cannot be controlled even though all preventive measures are in place. Responsibility centres are answerable for all adverse variances which could have been controlled. Controllability is a subjective matter and varies from situation to situation. If the uncontrollable variances are of significant nature and are persistent, the standard may need revision.

Favourable and Adverse variance: Favourable variances are those which are profitable for the company and adverse variances are those which causes loss to the company. While computing cost variances favourable variance means

actual cost is less than standard cost. On the other hand, adverse variance means

actual cost is exceeding standard cost. The situation will be reversed for sales variance. Favourable variances mean actual is more than budgeted and adverse when actual is less than budgeted. Favourable variance in short denoted by capital ‘F’ and adverse variances by capital ‘A’.

6. CLASSIFICATION OF VARIANCES

Variances are broadly classified into two parts namely Revenue variance and Cost variance. At Revenue side variances is calculated by comparing actual sales from budgeted (standard) sales. On the other hand, Cost side reflects variances in cost components. Cost variance classification is shown below with the help of a structured diagram.

*Idle time variance may also be shown separately from labour efficiency variance.

7. COMPUTATION OF VARIANCES

As discussed earlier variances are classified into two parts. Here we will start from cost side and discuss all cost components one by one with the help of appropriate example and illustrations.

Material Cost Variance

Material cost variance is the difference between standard cost of materials used and the actual cost of materials. Mathematically it is written as.

Material Cost Variance = [Standard Cost - Actual Cost]

Or

[(Std. Quantity x Std. Price)-(Actual Quantity x Actual Price)]

(The difference between the Standard Material Cost of teh actual production volume and the Actual Cost of Material)

Reasons for variance: Material cost variance arises mainly because of either difference in material price from the standard price or difference in material consumption from standard consumption or both the reasons. Analysis of material cost variance is done dividing it into two parts namely Material Price variance and Material Usage variance.

(A) Material Price Variance

It measures variance arises in the material cost due to difference in actual material purchase price from standard material price. Mathematically it is written as:

Material Price Variance = [Standard Cost of Actual Quantity* – Actual Cost]

Or

Actual Quantity (AQ) × {Std. Price (SP) – Actual Price(A)}

Or

[(SP × AQ) – (AP × AQ)]

(The difference between the Standard Price and Actual Price for the Actual Quantity Purchased)

*Here actual quantity means actual quantity of material purchased. If in the question material purchase is not given, it is taken as equal to material consumed.

Explanation: Material price variance can also be calculated taking material used as actual quantity instead of material purchased. This method is also correct but does not serve the purpose of variance computation. Material price variance may arise from variety of reasons out of which some may be controllable and some may be beyond the control of the purchase department. If price variance arises due to inefficiency of purchase department or any other reason within the control of the company, then it is very important to report variance as early as possible and this can be done by taking purchase quantity as actual quantity for price variance computation.

Responsibility for Material Price Variance: Generally, purchase department purchases materials from the market. Purchase department is expected to perform its function very prudently so that company never suffers loss due to its inefficiency. Purchase department is held responsible for adverse price variance arises due to the factors controllable by the department.

(B) Material Usage Variance

It measures variance in material cost due to usage/ consumption of materials. It is computed as below:

Material Usage Variance = [Standard Cost of Standard Quantity for Actual Production – Standard Cost of Actual Quantity*]

Or

Std. Price (SP)× {Std. Quantity (SQ) - Actual Quantity (AQ)}

Or

[(SQ × SP) – (AQ × SP)]

(The difference between the Standard Quantity specified for actual production

and the Actual Quantity used, at Standard Price)

*Here actual quantity means actual quantity of material used.

Responsibility for material usage variance: Material usage is the responsibility of production department and it is held responsible for adverse usage variance.

Reasons for variance: Actual material consumption may differ from the standard quantity either due to difference in proportion used from standard proportion or due to difference in actual yield from standard yield.

Material usage variance is divided into two parts (a) Material usage mix variance and (b) Material yield variance.

(a) Material Mix Variance

Variance in material consumption may arise due to difference in proportion actually used from the standard mix/ proportion. It only arises when two or more inputs are used to produce a product. Mathematically,

Material Mix Variance = [Standard Cost of Actual Quantity in Standard Proportion – Standard Cost of Actual Quantity]

Or

Std. Price (SP) × {Revised Std. Quantity (RSQ) – Actual Quantity (AQ)}

Or

[(RSQ × SP) – (AQ × SP)]

(The difference between the Actual Quantity in standard proportion and Actual Quantity in actual proportion, at Standard Price)

(b) Material Yield Variance (Material Sub-usage Variance)

Variance in material consumption which arises due to yield or productivity of the inputs. It may arise due to use of sub- standard quality of materials, inefficiency of workers or due to wrong processing.

Material Yield Variance = [Standard Cost of Standard Quantity for Actual Production – Standard Cost of Actual Quantity in standard proportion]

Or

Std. Price (SP) × {Std. Quantity (SQ) – Revised Standard Quantity (RSQ)}

Or

[(SQ × SP) – (RSQ × SP)]

(The difference between the Standard Quantity specified for actual production

and Actual Quantity in standard proportion, at Standard Purchase Price)

Verification of the formulae:

Material Cost Variance= Material Usage Variance + Material Price Variance*

Or, Material Cost Variance= (Material Mix Variance + Material Revised usage Variance) + Material price variance

*If material purchased quantity and material consumed quantity is same

Meaning of the terms used in the formulae:

| Term |

Meaning |

| Standard Quantity (SQ) |

Quantity of inputs to be used to produce actual output. |

| Actual Quantity (AQ) |

Quantity of inputs actually used to produce actual output. |

| Revised Standard Quantity (RSQ) |

If Actual total quantity of inputs were used in standard proportion. |

Labour Cost Variance

Amount paid to employees for their labour is generally known as employee or labour cost. In this chapter labour cost is used to denote employees cost. Labour (employee) cost variance is the difference between actual labour cost and standard cost. Mathematically it can be written as:

Labour Cost Variance = [Standard Cost – Actual Cost]

Or

[(SH × SR) – (AH* × AR)]

(The difference between the Standard Labour Cost and the Actual Labour Cost

incurred for the production achieved)

* Actual hours paid.

Reasons for variance: Difference in labour cost arises either due to difference in the actual labour rate from the standard rate or difference in numbers of hours worked from standard hours. Labour cost variance can be divided into three parts namely (i) Labour Rate Variance (ii) Labour Efficiency Variance and (iii) Labour Idle time Variance.

(A) Labour Rate Variance:

Labour rate variance arises due to difference in actual rate paid from standard rate. It is very similar to material price variance. It is calculated as below:

Labour Rate Variance = [Standard Cost of Actual Time – Actual Cost]

Or

Actual Hours (AH*) × {Std. Rate (SR) – Actual Rate (AR)}

Or

[(SR×AH*) – (AR × AH*)]

(The difference between the Standard Rate per hour and Actual Rate per hour

for the Actual Hours paid)

* Actual hours paid.

Responsibility for labour rate variance: Generally labour rates are influenced by the external factors which are beyond the control of the organisation. However, personnel manager is responsible for labour rate negotiation.

(B) Labour Efficiency Variance:

Labour efficiency variance arises due to deviation in the working hours from the standard working hours.

Labour Efficiency Variance =

[Standard Cost of Standard Time for Actual Production – Standard Cost of Actual Time]

Or

Std. Rate (SR) × {Std. Hours (SH) – Actual Hours (AH*)}

Or

[(SH × SR) – (AH# × SR)]

(The difference between the Standard Hours specified for actual production and Actual Hours worked at Standard Rate).

*Actual Hours worked

Responsibility for labour efficiency variance: Efficiency variance may arise due to ability of the workers, inappropriate team of workers, inefficiency of production manager or foreman etc. However, production manager or foreman can be held responsible for the adverse variance which otherwise can be controlled.

Labour efficiency variance is further divided into the following variances:

- Labour Mix Variance or Gang variance

- Labour Yield Variance (or Labour Revised-efficiency Variance)

(a) Labour Mix Variance:

Labour efficiency variance which arises due to change in the mix or combination of different skill set i.e. number of skilled workers, semi-skilled workers and un-skilled workers. Mathematically,

Labour Mix Variance Or Gang Variance =

[Standard Cost of Actual Time Worked in Standard Proportion – Standard Cost of Actual Time Worked]

Or

Std. Rate (SR) × {Revised Std. Hours (RSH) – Actual HoursWorked (AH)}

Or

[(RSH × SR) – (AH# × SR)]

(The difference between the Actual Hours worked in standard proportion and Actual Hours worked in actual proportion, at Standard Rate).

*Actual Hours worked

(b) Labour Yield Variance:

Labour efficiency variance which arises due to productivity of workers.

Labour Yield Variance Or Sub-Efficiency Variance = [Standard Cost of Standard Time for Actual Production – Standard Cost of Actual Time Worked in Standard Proportion]

Or

Std. Rate (SR) × {Std. Hours (SH) – Revised Std. Hours (RSH)}

Or

[(SH × SR) – (RSH × SR)]

(The difference between the Standard Hours specified for actual production and Actual Hours worked in standard proportion, at Standard Rate).

(C) Idle Time Variance:

It is calculated for the idle hours. It is difference between paid and worked hours. It is calculated as below:

Labour Idle Time Variance = [Standard Rate per Hour × Actual Idle Hours]

Or

Std. Rate (SR) {Actual HoursPaid – Actual HoursWorked}

Or

[(AH*× SR) – (AH# ×SR)]

(The difference between the Actual Hours paid and Actual Hours worked at Standard Rate)

* Actual hours paid; # Actual Hours worked

Verification of formulae:

Labour Cost Variance = Labour Rate Variance + Labour Efficiency Variance (if hours paid and hours worked is same)

OR

Labour Cost Variance = Labour Rate Variance + Idle Time Variance + Labour Efficiency Variance

OR

Labour Efficiency Variance = Labour Mix Variance + Labour Yield Variance

Variable Overheads Cost Variance

Variable overheads consist of expenses other than direct material and direct labour which vary with the level of production. If variable overhead consist of indirect materials, then in this case it varies with the direct material used. On the other hand, if variable overhead is depending on number of hours worked then in this case it will vary with labour hour or machine hours. If nothing is mentioned specifically then we take labour hour as basis. Variable overhead cost variance calculation is similar to labour cost variance. Variable overhead cost variance is divided into two parts (i) Variable Overhead Expenditure Variance and (ii) Variable Overhead Efficiency Variance.

Variable Overhead Cost Variance

(Standard Variable Overheads for Actual Production – Actual Variable Overheads)

Variable Overhead Expenditure (Spending) Variance

(Standard Variable Overheads for Actual Hours#)

Less

(Actual Variable Overheads)

[(SR – AR) × AH#]

Or

[(SR × AH#) – (AR × AH#)]

Variable Overhead Efficiency Variance

(Standard Variable Overheads for Production)

Less

(Standard Variable Overheads for Actual Hours#)

[(SH – AH#) × SR]

# Actual Hours (Worked)

Meaning of the terms used in the formulae:

| Term |

Meaning |

| Standard Hours (SH) |

Hours required producing actual output |

| Actual Hours (AH) |

Actual Hours taken toproduce output |

| Revised Standard Hours (RSH) |

If actual labour hours worked were worked by standard mix (combination) of labour. |

| Actual Yield (AY) |

Actual hours worked |

| Standard Yield (SY) |

Actual hours if labour worked in standard ratio |

| Standard Labour Cost (SLC) |

Standard labour cost for actual output |

Fixed Overhead Cost Variance

The recovery of the fixed components of the estimated overheads depends upon capacity utilization.

In case a company produces less than the projected utilization it shall not be able to recover all the budgeted fixed overheads. This unrecovered portion is known as production volume variance.

The other variance is because of variations in actual spending when compared with both estimated fixed and estimated variable overheads. Such a variance is known as Overhead expenses variance.

The following detailed discussion shall help you have a clear understanding of these two variances.

(1) Production Volume Variance: The term fixed overheads implies that the element of cost does not vary directly in proportion to the output. In other words, fixed overheads do not change within a given range of activity.

However, the unit cost changes even though the fixed overheads are constant in total within the given range of output. So, higher the level of activity, the lower will be the unit cost or vice versa.

The management is, therefore, faced with a costing difficulty because it requires a representative rate for charging fixed overheads irrespective of changes in volume of output. For example, if the fixed overheads are ` 10,000 and the output varies from 8,000 to 11,000 units, the cost per unit of output would be as under:

| Fixed Overheads |

Output in units |

Cost per unit of output |

| 10,000 |

8,000 |

1.25 |

| 10,000 |

9,000 |

1.11 |

| 10,000 |

10,000 |

1.00 |

| 10,000 |

11,000 |

0.91 |

We have, however, seen that in standard costing, a predetermined rate of overhead recovery is established for costing purposes. This involves the establishment of a predetermined capacity.

If we take, for example; 10,000 units as predetermine volume/capacity, the pre- determined rate will be `1 per unit. If the factory produces only 8,000 units, there will be a loss due to under-recovery which can be explained in two-ways:

- The actual cost will be `10,000 ÷ 8,000 units = `1.25 per unit whereas the absorbed cost is `1 per hour. Since the cost is more by `0.25 per unit, the total loss is 8,000 units × ` 0.25 or ` 2,000.

- Since the factory has produced only 8,000 units, the amount of overheads recovered is 8,000 units × `1 or ` 8,000. Since fixed overheads are constant, the amount which should have been ideally incurred for the department is `10,000. Hence there is a difference of `2,000 between the overheads recovered and the overheads estimated. This variance is known as production volume variance.

This shows the cost of failure on the part of the factory to produce at the planned activity of 10,000 units. If the company produces 11,000 units, the variance will show the benefits of operating at a level above the budgeted activity. If, however, the factory has produced 10,000 units, there will be no production volume variance because the actual activity equals what was budgeted i.e. the production of 10,000 units.

(2) Overhead Expenses Variance: As discussed above, the Production Volume Variance analyses the unrecovered fixed overheads. Apart from this, there can be variations in the actual spending of both fixed and variable overheads when compared to what was established as a standard. Such variations can be accounted for by analyzing an overhead expenses variance.

The analysis of overhead variances is different from that of material and labour variances. As overhead is the aggregate of indirect materials, indirect labour and indirect expenses, this variance is considered to be a difficult part of variance analysis. It is important to understand that overhead variance is nothing but under or over-absorption of overhead.

Fixed Overhead Cost Variance: Fixed overhead cost variance is the difference between actual fixed overhead and absorbed fixed overhead. Fixed overhead variance is divided into two parts (A) Fixed Overhead Expenditure Variance and (B) Fixed Overhead Volume Variance.

- Fixed Overhead Expenditure Variance: This is the difference between the actual fixed overhead incurred and budgeted fixed overhead.

- Fixed Overhead Volume Variance: Variance in fixed overhead which arise due to the volume of production is called fixed overhead volume variance.

Fixed overhead volume variance is further divided into the three variances:

- Efficiency Variance

- Capacity Variance and

- Calendar Variance

Mathematically these can be written as follows:

Fixed Overhead Cost Variance

(Absorbed Fixed Overheads) Less (Actual Fixed Overheads)

(SH × SR) –(AH × AR)

Fixed Overhead Expenditure Variance

(Budgeted Fixed Overheads)

Less

(Actual Fixed Overheads)

Or

(BH × SR) – (AH × AR)

Fixed Overhead Volume Variance

(Absorbed Fixed Overheads)

Less

(Budgeted Fixed Overheads)

Or

(SH × SR) – (BH × SR)

Fixed Overhead Capacity Variance

SR (AH – BH)

Or

(AH × SR) – (BH × SR)

Fixed Overhead Calendar Variance

Std. Fixed Overhead rate per day (Actual no. of Working days – Budgeted Working days)

Fixed Overhead Efficiency Variance

SR(SH – AH)

Or

(SH × SR) – (AH × SR)

- Fixed Overhead Efficiency Variance: This is the difference between fixed overhead absorbed and standard fixed overhead.

- Fixed Overhead Capacity Variance: This is the difference between standard fixed overhead and budgeted overhead.

- Fixed Overhead Calendar Variance: This variance arises due to difference in number of actual working days and the standard working days.

Note: When calendar variance is computed, there will be a modification in the capacity variance. In that case revised capacity variance will be calculated and the formula is:

Revised Capacity Variance = (Actual hours – Revised budgeted hours) × Std. fixed rate per hour

Verification of formulae:

F.O. Cost Variance = F.O. Expenditure Variance + F.O. Volume Variance

F.O. Volume Variance = Efficiency Variance + Capacity Variance + Calendar Variance

Basic terms used in the computation of overhead variance

Note: Separate overhead rates will be computed for fixed and variable overheads.

Basic calculations before the computation of overhead variances:

The following basic calculation should be made before computing variances.

(i) When overhead rate per hour is used:

- Standard hours for actual output (SHAO)

SHAO = (Budgeted Hours / Budgeted Output) × Actual Output

- Absorbed (or Recovered) overhead = Std. hours for actual output × Std. overhead rate per hour

- Standard overhead = Actual hours × Std. overhead rate per hour

- Budgeted overhead = Budgeted hours × Std. overhead rate per hour

- Actual overhead = Actual hours × Actual overhead rate per hour

(ii) When overhead rate per unit is used

- Standard output for actual hours (SOAH)

SOAH = (Budgeted Output / Budgeted Hours) × Actual Hours

- Absorbed overhead = Actual output × Std. overhead rate per unit

- Standard overhead = Std. output for actual time × Std. overhead rate per unit

- Budgeted overhead = Budgeted output × Std. overhead rate per unit

- Actual overhead = Actual output × Actual overhead rate per unit

- Overhead cost variance = Absorbed overhead – Actual overhead

- OCV = (Std. hours for actual output × Std. overhead rate) – Actual overhead

8. ADVANTAGES AND CRITICISM OF STANDARD COSTING

Advantages of Standard Costing

Following are the advantages of standard costing.

- It serves as a basis for measuring operating performance and cost control. It is possible by setting standards, proper classification and determination of variances. It serves as a signal for prompt corrective action. It helps to report exceptional variances i.e. the only matters which are not proceeding according to plan are reported. This enables the managers to concentrate on essential matters only.

- It aids price fixing. Standard costing can be used to predict costs. Although actual cost may vary from day to day, standard costs will remain stable over a period of time and, where demand for a product is elastic, this information can be used as a basis for fixing the selling price.

- Introduction of standard costing facilitates evaluation of jobs and introduction of incentives. Job values can be determined by the use of evaluation and scale of wages fixed according to the responsibility involved in each job.

- Standard costing facilitates the estimation of the cost of new products with greater accuracy.

- It serves as a basis for inventory valuation. Standard costs are used for inventory valuation. A further advantage of this procedure is that material stock can be recorded in terms of quantities only.

- Standard costing is also used for the measurement of profit. The question of correct approach of calculating profit is very much related to methods of stock valuation and absorption of fixed overheads. Standard costing eliminates any variations in profit due to changes in stock values from one period to another thus provides a basis for the measurement of profit.

- Standard costing is used in planning, budgeting and decision making. Standard costs being the pre-determined costs, are particularly useful in planning and budgeting.

- Standard costing is used in standardisation of products, operations and processes, it improves the overall production efficiency and reduces costs.

- It provides objectives and targets to be achieved by each level of management and defines the responsibilities of departmental managers. Thus, the system serves as an incentive to the departmental head to achieve the targets set by the company.

- Standard costing sets a uniform basis for comparison of all elements of costs. Since care is taken in setting standards, the standards become unchanging units of comparison. The standard hour may be used as a basic unit to compare dissimilar products or processes.

- The maximum use of working capital, plant facilities and current assets is assured because wastage of materials and loss due to idle time are closely controlled.

Criticism of Standard Costing

The following are some of the criticism which may be leveled against the standard costing system. The arguments have been suitably answered as stated against each by advocates of the standard costing and hence they do not invalidate the usefulness of the system to business enterprises.

-

Variation in price: One of the chief problem faced in the operation of the standard costing system is the precise estimation of likely prices or rate to be paid. The variability of prices is so great that even actual prices are not necessarily adequately representative of cost. But the use of sophisticated forecasting techniques should be able to cover the price fluctuation to some extent. Besides this, the system provides for isolating uncontrollable variances arising from variations to be dealt with separately.

-

Varying levels of output: If the standard level of output set for pre- determination of standard costs is not achieved, the standard costs are said to be not realised. However, the statement that the capacity utilisation cannot be precisely estimated for absorption of overheads may be true only in some industries of jobbing type. In vast majority of industries, use of forecasting techniques, market research, etc., help to estimate the output with reasonable accuracy and thus the variation is unlikely to be very large. Prime cost will not be affected by such variation and, moreover, variance analysis helps to measure the effects of idle time.

-

Changing standard of technology: In case of industries that have frequent technological changes affecting the conditions of production, standard costing may not be suitable. This criticism does not affect the system of standard costing. Cost reduction and cost control is a cardinal feature of standard costing because standards once set do not always remain stable. They have to be revised.

-

Attitude of technical people: Technical people are accustomed to think of standards as physical standards and, therefore, they will be misled by standard costs. Since technical people can be educated to adopt themselves to the system through orientation courses, it is not an insurmountable difficulty.

-

Mix of products: Standard costing presupposes a pre-determined combination of products both in variety and quantity. The mixture of materials used to manufacture the products may vary in the long run but since standard costs are set normally for a short period, such changes can be taken care of by revision of standards.

-

Level of Performance: Standards may be either too strict or too liberal because they may be based on (a) theoretical maximum efficiency, (b) attainable good performance or (c) average past performance. To overcome this difficulty, the management should give thought to the selection of a suitable type of standard. The type of standard most effective in the control of costs is one which represents an attainable level of good performance.

-

Standard costs cannot possibly reflect the true value in exchange. If previous historical costs are amended roughly to arrive at estimates for ad hoc purposes, they are not standard costs in the strict sense of the term and hence they cannot also reflect true value in exchange. In arriving at standard costs, however, the economic and technical factors, internal and external, are brought together and analysed to arrive at quantities and prices which reflect optimum operations. The resulting costs, therefore, become realistic measures of the sacrifices involved.

-

Fixation of standards may be costly: It may require high order of skill and competency. Small concerns, therefore, feel difficulty in the operation of such system.