THE NEGOTIABLE INSTRUMENTS ACT, 1881

Table of content

1. INTRODUCTION

The law relating to negotiable instruments is the law of the commercial world which was enacted to facilitate the activities in trade and commerce making provision for giving sanctity to the instruments of credit which could be deemed to be convertible into money and easily passable from one person to another. In the absence of such instruments, the trade and commerce activities were likely to be adversely affected as it was not practicable for the trading community to carry with it the bulk of the currency in force. The source of Indian law relating to such instruments is admittedly the English Common Law.

The main objective of the Act is to legalise the system by which instruments contemplated by it could pass from hand to hand by negotiation like any other goods.

The Law in India relating to negotiable instruments is contained in the Negotiable Instruments Act, 1881. This is an Act to define and amend the law relating to promissory notes, bills of exchange and cheques. The Act applies to the whole of India, but nothing herein contained affects the Reserve Bank of India Act, 1934, (section 21 which provides the Bank to have the right to transact Government business in India), or affects any local usage relating to any instrument in an oriental language.

Provided that such usages may be excluded by any words in the body of the instrument, which indicate an intention that the legal relations of the parties thereto shall be governed by this Act; and it shall come into force on the first day of March, 1882.

The provisions of this Act are also applicable to Hundis, unless there is a local usage to the contrary. Other native instruments like Treasury Bills, Bearer Debentures etc. are also considered as negotiable instruments either by mercantile custom or under other enactments.

Recent developments: The Act was amended several times. Recent three amendments made in the N.I. Act were the Negotiable Instruments (Amendment and Miscellaneous Provisions) Act, 2002 and the Negotiable Instruments (Amendment) Act, 2015 and Negotiable Instruments (Amendment) Act, 2018.

The Negotiable Instruments (Amendment) Act, 2018 received the assent of the President and was notified in the Official Gazette on 2nd August, 2018 and came into effect from September 1, 2018.

The Amendment Act 2018 contains two significant changes – the introduction of Section 143A and Section 148. These sections provide for interim compensation during the pendency of the criminal complaint and the criminal appeal.

2. MEANING OF NEGOTIABLE INSTRUMENTS

Negotiable Instruments is an instrument (the word instrument means a document) which is freely transferable (by customs of trade) from one person to another by mere delivery or by indorsement and delivery. The property in such an instrument passes to a bonafide transferee for value.

The Act does not define the term ‘Negotiable Instruments’. However, Section 13 of the Act provides for only three kinds of negotiable instruments namely, bills of exchange, promissory notes and cheques, payable either to order or bearer.

A negotiable instrument is payable to order when

- It is expressed to be so payable

- When it is expressed to be payable to a specified person and does not contain words prohibiting its transfer. (i.e. it is transferrable by indorsement and delivery)

A negotiable instrument is payable to bearer when

- When it is expressed to be so payable e.g. pay bearer

- When the only or last indorsement (indorsement means signing of the instrument) on the instrument is an indorsement in blank

Essential Characteristics of Negotiable Instruments

- It is necessarily in writing.

- It should be signed.

- It is free transferable from one person to another.

- Holders title is free from defects.

- It can be transferred any number of times till its satisfaction.

- Every negotiable instrument must contain an unconditional promise or order to pay money. The promise or order to pay must consist of money only.

- The sum payable, the time of payment, the payee, must be certain.

- The instrument should be delivered. Mere drawing of instrument does not create liability.

Presumptions as to Negotiable Instruments [Section 118]

| Presumptions made in Relation |

Presumption drawn |

| Until the contarry is proved, the following presumption shall be made: |

| of consideration |

every negotiable instrument was made or drawn for consideration |

| as to date |

every negotiable instrument bearing a date was made or drawn on such date |

| as to time of acceptance |

every accepted bill of exchange was accepted within a reasonable time after its date and before its date and before its maturity |

| as to time to transfer |

every transfer of a negotiable instrument was made before its maturity |

| as to order of indorsements |

indorsements appearing upon a negotiable instrument were made in the order in which they appear thereon |

| as to stamps |

lost promissory note, bill of exchange or cheque was duly stamped |

| as to holder the holder |

the holder of a negotiable isntrument is a holder in due course |

The above presumptions are rebuttable by evidence to the contrary.

3. PROMISSORY NOTE

Meaning

According to section 4 of the NI Act, 1881, “A “promissory note” is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument.”

Specimen of Promissory note

Parties to promissory note

Parties to promissory note

- Maker: The person who makes the promise to pay is called the Maker. He is the debtor and must sign the instrument

- Payee: Payee is the person to whom the amount on the note is payable.

Essential Characteristics of a Promissory Note

- In writing- An oral promise to pay is not sufficient.

- There must be an express promise to pay. Mere acknowledgment of debt is insufficient.

Example 1: I acknowledge myself to be indebted to B in ` 1,000, to be paid on demand, for value received. (Valid promissory note as the promise to pay is definite)

Example 2: “Mr. B I.O.U ` 1,000.” – Invalid promissory note as there is no promise to pay. It is just an acknowledgement of debt.

- The promise to pay should be definite and unconditional. Therefore, instruments payable on performance or non-performance of a particular act or on the happening or non-happening of an event, are not promissory notes. However, the promise to pay may be subject to a condition, which according to the ordinary experience of mankind, is bound to happen.

Example 3: I promise to pay B ` 500 seven days after my marriage with C. (the promissory note is invalid as marriage with C may or may not happen.)

Example 4: I promise to pay B ` 500 on D’s death- as the death of D is certain, promise in unconditional. Thus, the promissory note is valid.

Example 5: I promise to pay B ` 500 on D’s death, provided D leaves me enough to pay that sum. Invalid promissory note as promise is dependent on D leaving behind money which is not certain.

- A promissory note must be signed by the maker otherwise it is incomplete and ineffective.

- Promise to pay money only.

Example 6: I promise to pay B ` 500 and to deliver to him my black horse on 1st January next. – It is not a valid promissory note, as the promisor needs to deliver its black horse which is not money.

- Promise to pay a certain sum

Example 7: “I promise to pay B ` 500 and all other sums which shall be due to him.”- Promissory note invalid as the amount payable is not certain.

- The maker and payee must be certain, definite and different persons. A promissory note cannot be made payable to the bearer (Section 31 of RBI Act). Only the Reserve Bank or the Central Government can make or issue a promissory note 'payable to bearer'.

- Stamping: A promissory note must be properly stamped in accordance with the provisions of the Indian Stamp Act and such stamp must be duly cancelled by maker's signatures or initials or otherwise.

4. BILLS OF EXCHANGE

A “bill of exchange” is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument.

Specimen of Bill of Exchange

Parties to the bill of exchange

- Drawer: The maker of a bill of exchange.

- Drawee: The person directed by the drawer to pay is called the 'drawee'. He is the person on whom the bill is drawn. On acceptance of the bill, he is called an acceptor and is liable for the payment of the bill. His liability is primary and unconditional.

- Payee: The person named in the instrument, to whom or to whose order the money is, by the instrument, directed to be paid.

Essential characteristics of bill of exchange

- It must be in writing

- Must contain an express order to pay

- The order to pay must be definite and unconditional

- The drawer must sign the instrument

- Drawer, drawee and payee must be certain. All these three parties may not necessarily be three different persons. One can play the role of two. But there must be two distinct persons in any case. As per Section 31 of RBI Act, 1934, a bill of exchange cannot be made payable to bearer on demand.

- The sum must be certain

- The order must be to pay money only

- It must be stamped.

Process of bill of exchange

In above image, firstly the seller sold goods to the buyer/customer and then draws a bill of exchange on him. The Bill of exchange is delivered by the buyer who accepts it without any condition. On maturity of bill of exchange the buyer will pay the amount due to the payee. (The payee may be the drawer himself or a third party.)

Difference between promissory note and bill of exchange

| Basis |

Promissory Note |

Bill of Exchange |

| Definition |

"A Promissory Note" is an instrument in writing (not being a bank-note or a currency-note) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument. |

“A bill of exchange” is an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument. |

| Nature of Instrument |

In a promissory note there is a promise to pay money. |

In a bill of exchange there is an order for making payment. |

| Parties |

In a promissory note there are only 2 parties namely:

the maker and

the payee

|

In a bill of exchange, there are 3 parties which are follows

the drawer

the drawee

the payee

|

| Acceptance |

A promissory note does not require any acceptance, as it is signed by the person who is liable to pay. |

The Bills of Exchange need a acceptance from the drawee. |

| Payable to bearer |

A promissory note cannot be made payable to bearer. |

On the other hand a bill of exchange can be drawn payable to bearer. However, it cannot be payable to bearer on demand |

5. CHEQUE [SECTION 6]

A “cheque” is a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand and it includes the electronic image of a truncated cheque and a cheque in the electronic form.

Payable on demand means-

Payable on demand means- It should be payable whenever the holder chooses to present it to the drawee (the banker).

The expression “Banker” includes any person acting as a banker and any post office saving bank [Section 3]

Explanation I: For the purposes of this section, the expressions-

- Cheque in the electronic form-means a cheque drawn in electronic form by using any computer resource, and signed in a secure system with a digital signature (with/without biometric signature) and asymmetric crypto system or electronic signature, as the case may be;

Note- For the purposes of this section, the expressions "asymmetric crypto system", "computer resource", "digital signature", "electronic form" and "electronic signature" shall have the same meanings respectively assigned to them in the Information Technology Act, 2000.

- “a truncated cheque” means a cheque which is truncated during the course of a clearing cycle, either by the clearing house or by the bank whether paying or receiving payment, immediately on generation of an electronic image for transmission, substituting the further physical movement of the cheque in writing.

Explanation II: For the purposes of this section, the expression “clearing house” means the clearing house managed by the Reserve Bank of India or a clearing house recognized as such by the Reserve Bank of India.

Explanation III: For the purposes of this section, the expressions “asymmetric crypto system”, “computer resource”, “digital signature”, “electronic form” and “electronic signature” shall have the same meanings respectively assigned to them in the Information Technology Act, 2000.

A combined reading of section 5 and 6 tells us that a bill of exchange is a negotiable instrument in writing containing an instruction to a third party to pay a stated sum of money at a designated future date or on demand. Whereas, a cheque is also a bill of exchange but is drawn on a banker and payable on demand.

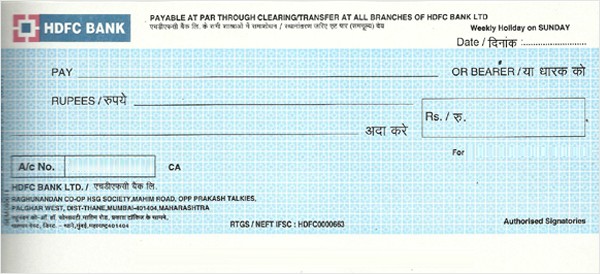

Specimen of Cheque

Parties to Cheque

- Drawer: The person who draws a cheque i.e. makes the cheque. (Debtor) His liability is primary and conditional.

- Drawee: The specific bank on whom cheque is drawn. He makes the payment of the cheque. In case of cheque, drawee is always banker.

“drawee in case of need”— When in the bill or in any indorsement thereon the name of any person is given in addition to the drawee to be resorted to in case of need such person is called a “drawee in case of need

- Payee: The person named in the instrument (i.e. the person in whose favour cheque is issued), to whom or to whose order the money is, by the instrument, directed to be paid, is called the payee. The payee may be the drawer himself or a third party.

Essential Characteristics of a cheque

Essential Characteristics of a cheque

According to the definition of cheque under section 6, a cheque is a species of bill of exchange. Thus, it should fulfil:

- all the essential characteristics of a bill of exchange

- Must be drawn on a specified banker

- It must be payable on demand

6. CROSSING OF CHEQUES [SECTION 123 – 131]

There are two types of cheques, open cheques and crossed cheques. A cheque which can be presented to the banker and can be paid at the counter of the bank is called an open cheque. If the drawer loses an open cheque, the finder of it may go to the bank and get payment unless its payment has been stopped. The finder may also transfer it to a holder in due course who is entitled to the money represented by the cheque. It was to prevent the losses incurred by open cheques getting into the hands of wrong person.

When a cheque bears across its face two parallel transverse lines, the cheque is said to be crossed. The lines are usually drawn on the left hand top corner, but may be drawn anywhere.

Meaning of crossing: Crossing of a cheque means an instruction to the drawee

i.e. the paying bank that the payment is not to be made at the counter but through a bank.

Objects of Crossing: A crossing is a warning to the bank not to make payment of the crosses cheque over the counter. Crossing operates as a caution to the paying banker.

- Crossing affects the mode of payment of cheque- An open or uncrossed cheque is payable to the payee or holder at the counter of the bank. In such a case, if a wrong person takes away the payment of cheque, it is difficult to trace him.

The payment of a cross cheque can be obtained only through a banker. Thus, crossing is a mode of assuring that only the rightful holder (i.e. the person entitled to receive money) gets payment.

- Crossing does not affect the transferability or negotiability of cheque- a crossed cheque can be negotiated just the same way as an open cheque. A person acquiring a crossed cheque in good faith becomes its holder in due course just as in case of open cheque.

- Crossing is a material alteration but crossing of cheque by the holder does not in any way affect his rights in respect of cheques (section 125).

TYPES OF CROSSING:

- General Crossing: Where a cheque bears across its face two parallel, transverse lines without any words or with words ‘and company’ or/and ‘not negotiable’ written in between these two parallel lines, it is called general crossing. Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker (Sec. 126)

- Special Crossing: where the lines of crossing bear the name of a banker either with or without any additional words. The effect is that its payment can be obtained only through particular banker whose name appears between the lines.

According to Section 127, where a cheque is crossed specially to more than one banker, the banker on whom it is drawn shall refuse payment thereof except where the banker to whom it is crossed may cross it specially to another banker, his agent for collection.

- A/c payee crossing: When the words “A/C payee” or “A/C payee only” are added to a general or special crossing, it is called restrictive crossing. The effect of “Account payee” crossing is that the banker is supposed to collect the cheque on behalf of that payee only whose name appears on the face of the cheque. If banker collects this cheque from an indorsee (i.e. person other than named payee), he can be held responsible in case that indorsee turns out to be a wrongful holder of cheque. Thus, liability of a banker enhances to a great extent. Such type of crossing is not statutorily recognised.

- Not negotiable Crossing: This requires writing of words “not negotiable” in addition to the two parallel lines. These words may be written inside or outside these lines. According to Section 130, a person taking a cheque crossed generally or specially, bearing in either case the word “not negotiable” shall not have, and shall not be capable of giving a better title to the cheque than that which the person from whom he took it. It is a statutory crossing. A cheque with such crossing is not negotiable, but continues to be transferable as before. Ordinarily, in a negotiable instrument, if the title of the transferor is defective, the transferee, if he is a HDC, will have a good title. When the words ”not negotiable” are written, even a HDC will get the same title as that of transferor. Thus, if the title of the transferor is defective, the title of transferee will also be so.

Thus, the addition of the words not negotiable does not restrict the further transferability of the cheque, but it entirely takes away the main feature of negotiability, which is that a holder with a defective title can give a good title to the subsequent holder in due course.

Who may cross? [Section 125]

A cheque may be crossed by the following parties:

- By Drawer: A drawer may cross it generally or specially.

- By Holder: A holder may cross an uncrossed cheque generally or specially. If the cheque is crossed generally, the holder may cross specially. If cheque crossed generally or specially, he may add words “not negotiable”.

- By Banker: A banker may cross an uncrossed cheque, or if a cheque is crossed generally he may cross it specially to himself. Where a cheque is crossed specially, the banker to whom it is crossed may again cross it specially to another banker, his agent, for collection.

PROTECTION OF LIABILITY OF THE PAYING BANKER:

The banker who makes the payment of a crossed cheque is called the paying banker.

- Cheque payable to order [Section 85(1)]: Where a cheque payable to order purports to be indorsed by or on behalf of the payee, the banker is discharged by payment in due course. The banker, in other words, can debit his customers account even though the indorsement by the payee might turn out to be forgery or the indorsement might have been placed by the payee’s agent without his authority.

- Cheque payable to bearer [Section 85(2)]: As regards bearer cheque, the rule is “once a bearer always a bearer”. A banker gets a good discharge by payment in due course of the amount on a bearer cheque to the holder of the cheque. It does not matter whether the apparent holder is the owner of the cheque or not.

- Payment of cheque crossed generally: Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker.

- Payment of cheque crossed specially: Where a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed, or his agent for collection.

- Payment in due course of crossed cheque [Section 128]: Where the banker on whom a crossed cheque is drawn has paid the same in due course, the banker paying the cheque, and (in case such cheque has come to the hands of the payee) the drawer thereof, shall respectively be entitled to the same rights, and be placed in the same position in all respects, as they would respectively be entitled to and placed in if the amount of the cheque had been paid to and received by the true owner thereof

- Payment of crossed cheque out of due course [Section 129]: Any banker paying a cheque crossed generally otherwise than to a banker, or a cheque crossed specially otherwise than to the banker to whom the same is crossed, or his agent for collection, being a banker, shall be liable to the true owner of the cheque for any loss he may sustain owing to the cheque having been so paid.

EXCEPTION: Payment of a cheque on which drawer signatures were forged: If any drawee banks made the payment on a cheque on which drawer signatures were forged then such bank shall be liable to the true owner. Thus, the paying banker shall be liable if it makes the payment of the cheque on which drawers signature was forged.

PROTECTION OF LIABILITY OF THE COLLECTING BANKER

The bank which receives the payment of a crossed cheque on behalf of its customer is known as the collecting banker.

Section 131- Non liability of banker receiving payment of cheque: A banker who has in good faith and without negligence received payment for a customer of a cheque crossed generally or specially to himself shall not, in case the title of the cheque proves defective, incur any liability to the true owner of the cheque by reason only of having received such payment.

In order to avail such a protection, the banker needs to prove the following:

- That the banker had received the payment of crossed cheque

- That the collection was made by the bank on behalf of the customer

- That the collecting bank must have acted in good faith and without negligence.

7. ACCEPTOR AND ACCEPTOR FOR HONOR

ACCEPTOR AND ACCEPTOR FOR HONOUR

“Acceptor” [Section 7] - After the drawee of a bill has signed his assent upon the bill, or, if there are more parts thereof than one, upon one of such parts, and delivered the same, or given notice of such signing to the holder or to some person on his behalf, he is called the “acceptor”. Thus, an acceptor is the drawee who has signed his assent upon the bill and delivered it to the holder.

“Acceptor for honour” [Section 7] - When a bill of exchange has been dishonoured by non-acceptance and any person accepts it for honour of the drawer or of any indorsers, such person is called "an Acceptor for honour".

The payment which he makes is known as “payment for honour. In other words, it is an undertaking by a third party to accept and pay a bill of exchange that was dishonored, either by non-acceptance (see dishonor by non-acceptance) or by non-payment (see dishonor by non payment) by the party on whom it was drawn. It is also called acceptance supra protest.

How acceptance for honor must be made: A person desiring to accept for honor must, [by writing on the bill under his hand], declare that he accepts under protest the protested bill for the honor of the drawer or of a particular indorser whom he names, or generally for honor.

Example 8: The acceptor for honor may writes across the bill of exchange “Accepted Supra Protest” or “Accepted for AB (the name of drawee)”.

Essentials of valid acceptance for honor

- The holder must consent to acceptance for honor. The holder cannot be compelled to assent to acceptance for honor.

- The bill must have been noted or protested for the non-acceptance or for better security.

- Acceptance for honor can be made by a person who is not already liable on the bill. Drawee of the bill when he refuses to accept the bill becomes a stranger. He may therefore accept the bill for honor of any party thereto.

- It must be made by writing on the bill.

- It must be for the whole amount due on the bill

- Acceptance must be for the honor of any party already liable on the bill.

- Acceptance for honor must be made before to bill is overdue.

- Stranger paying for honor must, before payment, declare before a Notary Public the party for whose honor he pays and the Notary Public must have recorded such a declaration.

Rights and liabilities of an acceptor for honour (Sections 111 & 112)

- Acceptor for honor binds himself to all the subsequent parties to pay the amount of the bill if the drawee does not pay.

- The party for whose honor he accepts to pay the amount and all prior parties are liable to compensate the acceptor for honor for all loss or damage sustained by him in consequence of such acceptance. The liability of an acceptor or honor is conditional he is liable only if the drawee fails to pay the bill.

The bill of exchange should be presented at its maturity to the drawee for payment and it must be dishonored by the drawee and noted or protested for non-payment to charge an acceptor for honor (Section 112). The bill must be presented or forwarded for presentment to the drawee not later than the day next after the day of its maturity.

8. HOLDER AND HOLDER IN DUE COURSE

“Holder” [Section 8] — the “holder” of a promissory note, bill of exchange or cheque means—

- any person

- entitled in his own name to the possession thereof, and

- to receive or recover the amount due thereon from the parties thereto.

Where the note, bill or cheque is lost or destroyed, its holder is the person so entitled at the time of such loss or destruction.

Broadly speaking, a holder means the owner of a negotiable instrument. What is required is a right to possession. A person in possession of an instrument without having a right to possess can’t be called a holder.

Example 9: A person who finds or steals a bearer instrument or takes an instrument under forged indorsement is not holder. The reason is that holder of a negotiable instrument must have right to receive or recover the money thereon from the parties thereto.

Example 10: An agent holding an instrument for his principal is not a holder. The reason being that, although agent can receive payment of the instrument, he has no right to sue on the instrument in his own name.

“Holder in due course” [Section 9]— ”Holder in due course” means—

- any person

- who for consideration

- became the possessor of a promissory note, bill of exchange or cheque (if payable to bearer), or the payee or indorsee thereof, (if payable to order),

- before the amount mentioned in it became payable, and

- without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title.

Example 11: A draws a cheque for ` 5,000 and hands it over to B by way of gift. B is a holder but not a holder in due course as he does not get the cheque for value and consideration. His title is good and bonafide. As a holder he is entitled to receive ` 5000 from the bank on whom the cheque is drawn.

Example 12: On a Bill of Exchange for ` 1 lakh, X’s acceptance to the Bill is forged. ‘A’ takes the Bill from his customer for value and in good faith before the Bill becomes payable. State with reasons whether ‘A’ can be considered as a ‘Holder in due course’ and whether he (A) can receive the amount of the Bill from ‘X’.

Answer: According to section 9 of the Negotiable Instruments Act, 1881 ‘holder in due course’ means any person who for consideration becomes the possessor of a promissory note, bill of exchange or cheque if payable to bearer or the payee or indorsee thereof, if payable to order, before the amount in it became payable and without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title.

As ‘A’ in this case prima facie became a possessor of the bill for value and in good faith before the bill became payable, he can be considered as a holder in due course.

But where a signature on the negotiable instrument is forged, it becomes a nullity. The holder of a forged instrument cannot enforce payment thereon. In the event of the holder being able to obtain payment in spite of forgery, he cannot retain the money. The true owner may sue on tort the person who had received. This principle is universal in character, by reason where of even a holder in due course is not exempt from it. A holder in due course is protected when there is defect in the title. But he derives no title when there is entire absence of title as in the case of forgery. Hence ‘A’ cannot receive the amount on the bill.

ESSENTIALS TO BECOME HOLDER IN DUE COURSE (HDC):

a) The holder must have paid valuable consideration:

- To become a holder in due course, a person must obtain a negotiable instrument by paying valuable and lawful consideration for it.

- When given as a gift or has been inherited, the transferee cannot be a holder in due course.

b) A holder must acquire the instrument before its maturity in order to attain the status of holder in due course.

c) The holder must have obtained the instrument in good faith.

d) The instrument must be complete and regular on the face of it.

e) He must have received the instrument as a holder- i.e. A HDC may be either payee, or the possessor (if the instrument is payable to bearer), or the indorsee (if the instrument is payable to order).

PRIVILEGES OF BEING A HOLDER IN DUE COURSE:

- In case of Inchoate Instrument: A person signing and delivering to another a stamped but otherwise inchoate instrument (When you execute an unfilled up but duly signed negotiable instrument such as a cheque or a promissory note, it is an inchoate negotiable instrument) is debarred from asserting, as against a holder in due course, that the instrument has not been filled in accordance with the authority given by him, the stamp being sufficient to cover the amount (Section 20).

Example 13: A signs his name on a blank but stamped instrument which he gives to B with an authority to fill up as a note for a sum of ` 3 000 only. But B fills it for ` 5,000. B then transfers it to C for a consideration of 5000 who takes it in good faith. Here in the case, C is entitled to recover the full amount of the instrument because he is a holder in due course whereas B, being a holder cannot recover the amount because he filled in the amount in excess of his authority.

- In case of fictitious bill: In case a bill of exchange is drawn payable to the drawer’s order in a fictitious name and is indorsed by the same hand as the drawer’s signature, it is not permissible for acceptor to allege as against the holder in due course that such name is fictitious (Section 42).

- In case of conditional instrument or ‘escrow’: In case a bill or note is negotiated to a holder in due course, the other parties to the bill or note cannot avoid liability on the ground that the delivery of the instrument was conditional or for a special purpose only.

- In case of instrument obtained by unlawful means or for unlawful consideration; The person liable in a negotiable instrument cannot set up against the holder in due course the defences that the instrument had been lost or obtained from the former by means of an offence or fraud or for an unlawful consideration (Section 58). Thus, a holder in due course acquires a title free from all defects.

- In case original validity of the instrument is denied; No maker of a promissory note, and no drawer of a bill or cheque and no acceptor of a bill for the honour of the drawer shall, in a suit thereon by a holder in due course be permitted to deny the validity of the instrument as originally made or drawn (Section 120). In short, a holder in due course gets a good title to the bill.

- In case Payee’s capacity to indorse is denied: No maker of a promissory note and no acceptor of a bill payable to order shall, in a suit thereon by a holder in due course, be permitted to deny the payee’s capacity, at the date of the note or bill, to indorse the same (Section 121). In short, a holder in due course gets a good title to the bill.

“Payment in due course” [Section 10]—”Payment in due course” means payment in accordance with the apparent tenor of the instrument in good faith and without negligence to any person in possession thereof under circumstances which do not afford a reasonable ground for believing that he is not entitled to receive payment of the amount therein mentioned.

9. CLASSIFICATION OF NEGOTIABLE INSTRUMENTS

“Bearer instrument” and “order instrument” [Section 13]

Bearer Instrument: It is an instrument where the name of the payee is blank or where the name of payee is specified with the words “or bearer” or where the last indorsement is blank. Such instrument can be negotiated by mere delivery.

Order Instrument: It is an instrument which is payable to a person or Payable to a person or his order or Payable to order of a person or where the last indorsement is in full, such instrument can be negotiated by indorsement and delivery.

“Inland instrument” and “Foreign instrument” [Sections 11 & 12]

A promissory note, bill of exchange or cheque drawn or made in India and made payable in, or drawn upon any person resident in India shall be deemed to be an inland instrument.

Example 14:

(i) A promissory note made in Kolkata and payable in Mumbai.

(ii) A bill drawn in Varanasi on a person resident in Jodhpur (although it is stated to be payable in Singapore)

“Foreign instrument”

Any such instrument not so drawn, made or made payable shall be deemed to be foreign instrument. In other words,

- Bills drawn outside India on a person resident in or outside India and made payable in India,

- Bills drawn outside India on a person residing outside India and payable in India or outside India.

- Bills drawn outside India on a person residing in or outside India and payable outside India are foreign bills.

Liability of maker/ drawer of foreign bill

In the absence of a contract to the country, the liability of the maker or drawer of a foreign promissory note or bill of exchange or cheque is regulated in all essential matters by the law of the place where he made the instrument, and the respective liabilities of the acceptor and indorser by the law of the place where the instrument is made payable (Section 134).

Example 15: A bill of exchange is drawn by A in Berkley where the rate of interest is 15% and accepted by B payable in Washington where the rate of interest is 6%. The bill is indorsed in India and is dishonoured. An action on the bill is brought against B in India. He is liable to pay interest at the rate of 6% only. But if A is charged as drawer, he is liable to pay interest at 15%.

Inchoate and Ambiguous Instruments

Inchoate and Ambiguous Instruments

Inchoate Instrument: It means an instrument that is incomplete in certain respects. The drawer/ maker/ acceptor/ indorser of a negotiable instrument may sign and deliver the instrument to another person in his capacity leaving the instrument, either wholly blank or having written on it the word ‘incomplete. Such an instrument is called an inchoate instrument’ and this gives a power to its holder to make it complete by writing any amount either within limits specified therein or within the limits specified by the stamp’s affixed on it. The principle of this rule of an inchoate instrument is based on the principle of estoppel.

The person signing and delivering the inchoate instrument is liable both to a holder and holder in due course. However, there is a difference in their respective rights. The holder of such an instrument cannot recover the amount in excess of the amount intended to be paid by the signor. The holder in due course can, however, recover any amount on such instrument provided it is covered by the stamp affixed on the instrument.

Section 20 of the Act reads as “Where one person signs and delivers to another a paper stamped in accordance with the law relating to negotiable instruments then in force in India, and either wholly blank or having written thereon an incomplete negotiable instrument, he thereby gives prima facie authority to the holder thereof to make or complete, as the case may be, upon it a negotiable instrument, for any amount specified therein and not exceeding the amount covered by the stamp. The person so signing shall be liable upon such instrument, in the capacity in which he signed the same, to any holder in due course for such amount. provided that no person other than a holder in due course shall recover from the person delivering the instrument anything in excess of the amount intended by him to be paid thereunder”,

Example 16: A person signed a blank acceptance on a bill of exchange and kept it in his drawer. The bill was stolen by X and he filled it up for ` 20,000 and negotiated it to an innocent person for value. It was held that the signer to the blank acceptance was not liable to the holder in due course because he never delivered the instrument intending it to be used as a negotiable instrument. Further, as a condition of liability, the signer as a maker, drawer, indorser or acceptor must deliver the instrument to another. In the absence of delivery, the signer is not liable. Furthermore, the paper so signed and delivered must be stamped in accordance with the law prevalent at the time of signing and on delivering otherwise the signer is not estopped from showing that the instrument was filled without his authority.

Ambiguous Instrument: Section 17 of the Acts, reads as: “Where an instrument may be construed either as a promissory note or bill of exchange, the holder may at his election treat it as either, and the instrument shall be thenceforward treated accordingly“.

Thus, an instrument which is vague and cannot be clearly identified either as a bill of exchange, or as a promissory note, is an ambiguous instrument. In other words, such an instrument may be construed either as promissory note, or as a bill of exchange. Section 17 provides that the holder may, at his discretion, treat it as either and the instrument shall thereafter be treated accordingly. Thus, after exercising his option, the holder cannot change that it is the other kind of instrument.

Where amount is stated differently in figures and words [Section 18]

If the amount undertaken or ordered to be paid is stated differently in figures and in words, the amount stated in words shall be the amount undertaken or ordered to be paid.

Demand and Time Instrument

Demand Instruments (Section 19): A promissory note or bill of exchange in which no time for payment is mentioned is payable on demand. Bills and notes are payable either on demand or at a fixed future time. Cheques are always payable on demand. A bill or promissory note is also payable on demand when it is expressed to be payable on demand, or "at sight" or "presentment" (Section 21). The expression “after sight” means, in a promissory note, after presentment for sight, and, in a bill of exchange after acceptance, or noting for non- acceptance, or protest for non-acceptance.

Time instrument (Section 22): A bill or note which is payable:

- After a fixed period or

- After sight or

- On a specified day or

- On the happening of an event which is certain to happen is known as time instrument.

“AT SIGHT”, “ON PRESENTMENT”, “AFTER SIGHT” [SECTION 21]

In a promissory note or bill of exchange the expressions “at sight” and “on presentment” means on demand.

The expression “after sight” means, in a promissory note, after presentment for sight, and, in a bill of exchange after acceptance, or noting for non-acceptance, or protest for non-acceptance.

“MATURITY OF NEGOTIABLE INSTRUMENT”

Where bill or note is payable at a fixed period after sight, the question of maturity becomes important. The maturity of a note or bill is the date on which it falls due.

Days of grace: A note or bill, which is not expressed to be payable on demand, at sight or on presentment; is at maturity on the third day after the day on which it is expressed to be payable. Thus, a time instrument payable after sight is allowed three days grace period (Section 22).

Calculation of maturity [Section 23]: In calculating the date at which a promissory note or bill of exchange, made payable at stated number of months after date or after sight, or after a certain event, is at maturity, the period stated shall be held to terminate on the day of the month, which corresponds with the day on which the instrument is dated, or presented for acceptance or sight, or noted for non-acceptance, or protested for non-acceptance, or the event happens or, where the instrument is a bill of exchange made payable at stated number of months after sight and has been accepted for honor, with the day on which it was so accepted. If the month in which the period would terminate has no corresponding day, the period shall be held to terminate on the last day of such month.

Example 17:

- A negotiable instrument dated 29th January, 2019, is made payable at one month after date. The instrument is at maturity on the third day after the 28th February, 2019.

- A negotiable instrument, dated 30th August, 2019, is made payable three months after date. The instrument is at maturity on the 3rd December, 2019.

- A promissory note or bill of exchange, dated 31st August, 2019, is made payable three months after date. The instrument is at maturity on the 3rd December, 2019.

Calculating maturity of bill or note payable so many days after date or sight [Section 24]

In calculating the date at which a promissory note or bill of exchange made payable at certain number of days after date or after sight or after a certain event is at maturity, the day of the date, or of presentment for acceptance or sight, or of protest for non-acceptance, or on which the event happens, shall be excluded.

Example 18: Bharat executed a promissory note in favour of Bhushan for ` 5 crores. The said amount was payable three days after sight. Bhushan, on maturity, presented the promissory note on 1st January, 2019 to Bharat. Bharat made the payments on 4th January, 2019. Bhushan wants to recover interest for one day from Bharat. Advise Bharat, in the light of provisions of the Negotiable Instruments Act, 1881, whether he is liable to pay the interest for one day?

Answer: Claim of Interest: Section 24 of the Negotiable Instruments Act, 1881 states that where a bill or note is payable after date or after sight or after happening of a specified event, the time of payment is determined by excluding the day from which the time begins to run.

Therefore, in the given case, Bharat will succeed in objecting to Bhushan’s claim. Bharat paid rightly “three days after sight”. Since the bill was presented on 1st January, Bharat was required to pay only on the 4th and not on 3rd January, as contended by Bhushan.

When day of maturity is a holiday [Section 25]

When the day on which a promissory note or bill of exchange is at maturity is a public holiday, the instrument shall be deemed to be due on the next preceding business day.

Explanation: The expression “Public Holiday” includes Sundays and any other day declared by the Central Government, by notification in the Official Gazette, to be a public holiday.

10. NEGOTIATION (TRANSFER) OF NEGOTIABLE INSTRUMENTS

One of the essential characteristics of a negotiable instrument is that it is freely transferable from one person to another. The rights in a negotiable instrument can be transferred from one person to another by negotiation.

According to Section 14 of the N.I. Act, when a negotiable instrument is transferred to any person with a view to constitute the person holder thereof, the instrument is deemed to have been negotiated. Thus, there is a transfer of ownership of the instrument. Negotiable instruments may be negotiated either by delivery when these are payable to bearer or by indorsement and delivery when these are payable to order.

Modes of Negotiation

- A promissory note, bill of exchange or cheque payable to bearer is negotiable by the delivery thereof.

- A promissory note, bill of exchange or cheque payable to order is negotiable by the holder by indorsement and delivery thereof.

Negotiation by delivery [Section 47]

Subject to the provisions of section 58 [Instrument obtained by unlawful means or for unlawful consideration], a promissory note, bill of exchange or cheque payable to bearer is negotiable by delivery thereof.

Exception: A promissory note, bill of exchange or cheque delivered on condition that it is not to take effect except in a certain event is not negotiable (except in the hands of a holder for value without notice of the condition) unless such event happens.

Example 19:

- A, the holder of a negotiable instrument payable to bearer, delivers it to B’s agent to keep for B. The instrument has been negotiated.

- A, the holder of a negotiable instrument payable to bearer, which is in the hands of A’s banker, who is at the time the banker of B, directs the banker to transfer the instrument to B’s credit in the banker’s account with B. The banker does so, and accordingly now possesses the instrument as B’s agent. The instrument has been negotiated, and B has become the holder of it.

Negotiation by indorsement [Section 48]

Subject to the provisions of section 58, a promissory note, bill of exchange or cheque payable to order, is negotiable by the holder by indorsement and delivery thereof.

Importance of Delivery in Negotiation [Section 46]

Delivery of an instrument is essential whether the instrument is payable to bearer or order for effecting the negotiation. The delivery must be voluntary and the object of delivery should be to pass the property in the instrument to the person to whom it is delivered. The delivery can be, actual or constructive. Actual delivery takes place when the instrument changes hand physically. Constructive delivery takes place when the instrument is delivered to the agent, clerk or servant of the indorsee on his behalf or when the indorser, after indorsement, holds the instrument as an agent of the indorsee.

Section 46 also lays down that when an instrument is conditionally or for a special purpose only, the property in it does not pass to the transferee, even though it is indorsed to him, unless the instrument is negotiated to a holder in due course.

The contract on a negotiable instrument until delivery remains incomplete and revocable. The delivery is essential not only at the time of negotiation but also at the time of making or drawing of negotiable instrument. The rights in the instrument are not transferred to the indorsee unless after the indorsement the same has been delivered. If a person makes the indorsement of instrument but before the same could be delivered to the indorsee the indorser dies, the legal representatives of the deceased person can’t negotiate the same by mere delivery thereof. (Section 57)

Delivery when effective between the parties

| Negotiation of instruments between the parties |

How delivery is to be made |

| As between parties standing in immediate relation |

Delivery to be effectual must eb made by the party making, accepting or endorsing the instrument, or by a person authorized by him in that behalf |

| As between such parties and any holder of the instrument other than a holder in due course |

It may be shown that the instrument was delivered conditionally or for a special purpose only, and not for the purpose of transferring absolutely the property therein |

INDORSEMENT OF INSTRUMENT (Section 15)

Meaning: When the maker or holder of a negotiable instrument signs the same otherwise than as such maker, for the purpose of negotiation, on the back or face thereof or on a slip of paper annexed thereto known as allonge (a French word meaning a slip of paper attached to the end of a BoE to give room for further indorsements)- he is said to indorse the same and called as the indorser. The person to whom the instrument is indorsed is called the indorsee. The indorsement, therefore, means, signatures of the person which are generally made at the back of the instrument, for the purpose of negotiation i.e. transfer of rights to another person. The signature may also be on the face of the instrument. No particular form of words is necessary for an indorsement.

INDORSEMENT: When the maker or holder of a negotiable instrument signs the same (otherwise than as such maker)—

- for the purpose of negotiation

- on the back or face thereof or on a slip of paper annexed thereto, or so signs for the same purpose a stamped paper intended to be completed as a negotiable instrument,

- he (maker/holder) is said to indorse the same, and is called the “indorser”.

Example 20: X, who is the holder of a negotiable instrument, writes on the back thereof: “pay to Y or order” and signs the instrument. In such a case, X is deemed to have indorsed the instrument to Y. If X delivers the instrument to Y, X ceases to be the holder and Y becomes the holder.

Indorsement “in blank” and “in full” ”endorsee” [Section 16]

- If the indorser signs his name only, the indorsement is said to be “in blank”, and if he adds a direction to pay the amount mentioned in the instrument to, or to the order of, a specified person, the indorsement is said to be “in full”, and the person so specified is called the “indorsee” of the instrument.

- The provisions of this Act relating to a payee shall apply with the necessary modifications to an indorsee.

Example 21: Blank (or general): No indorsee is specified in an indorsement in blank, it contains only the bare signature of the indorser. A bill so indorsed becomes payable to bearer.

Specimen

Motilal Poddar

Example 22: Special (or in full): In such an indorsement, in addition to the signature of the indorser the person to whom or to whose order the instrument is payable is specified.

Specimen

Pay to B, Batliwala or order.

S. Shroff

Various Kinds of Indorsement:

- Indorsement in Blank (only signature): Where the indorser just puts his signature without specifying the indorsee, the indorsement is said to be in blank (Section 16). The effect of such an indorsement is to render the instrument payable to bearer even though originally payable to order (Section 54).

- Indorsement in Full (name and signature): Where along with indorser's signature, the name of the indorsee is specified, the indorsement is called 'indorsement in full' (Section 16). Thus, where the instrument states, 'Pay X or order' and is signed by A, the payee, it constitutes 'indorsement in full'.

- Partial indorsement: An indorsement which purports to transfer only a part of amount of the instrument is called as partial indorsement. As per section 56, such an indorsement is invalid under law.

Example 23: A is a holder of a bill for ` 10000. A indorses it thus: “Pay B or order ` 5000”. This is partial indorsement and invalid for the purpose of negotiation.

Exception: Second part of section 56 states that if a bill has been paid in part, the fact of the part payment may be indorsed on the instrument and it may then be negotiated for the residue.

Example 24: A bill may be indorsed: Pay A or order ` 5000 being the unpaid residue of the bill. It is a valid indorsement.

- Restrictive Indorsement: An indorsement is restrictive when the indorser while making indorsement restricts or excludes the right of the indorsee to further transfer the instrument or constitutes the indorsee as an to indorse the instrument or to receive its content for the indorser or for some other specified person (Section 50). An indorsement is “restrictive” when it prohibits or restricts the further negotiability of the instrument. It merely entitles the holder of the instrument to receive the amount on the instrument for a specific purpose.

Example 25: D signs the following indorsements on different negotiable instruments payable to bearer:

(a) Pay the contents to G only

(b) Pay G for my use

(c) Pay G or order for the account of H

These indorsements exclude the right of further negotiation by G.

- Conditional indorsement: Section 52 gives power to an indorser to insert in the indorsement by express words, a stipulation negating (excluding) or limiting his own liability to the holder by making such liability or the right of the indorsee to receive the amount due thereon upon the happening of a specified event although such event may never happen.

Conditional indorsement can be achieved by an indorser in any of the following ways:

- Sans recourse indorsement- By excluding his liability e.g. the holder of a bill may indorse it thus: ‘Pay A or order without recourse to me, or Pay A or order sans recourse, or Pay A or order at his own risk’. In these cases, the holder does not incur any liability on the bill as an indorser.

- Liability dependent upon a contingency- By making his liability dependent upon the happening of a specified event which may never happen, in such a case the liability of the holder as an indorser, arises only upon the happening of the event specified, and is extinguished if the event becomes impossible, or the conditions specified are not fulfilled. But, the indorsee can sue the prior parties before the happening of the event.

- Facultative indorsement – In it, an indorser by express words abandons some right or increases his liability under an instrument. For example, the holder may waive presentment of the instrument for acceptance or notice of dishonor by the holder. An indorsement, ‘Pay A order. Notice of dishonor waived’ is a facultative indorsement.

- ‘Sans frais’ indorsement – Where the indorser does not want the indorsee or any subsequent holder to incur any expenses on his account on the instrument, the indorsement is ‘sans frais’.

CONVERSION OF INDORSEMENT IN BLANK INTO INDORSEMENT IN FULL [SECTION 49]

The holder of a negotiable instrument indorsed in blank may—

- without signing his own name, by writing above the indorser’s signature a direction to pay to any other person as indorsee, convert the indorsement in blank into an indorsement in full; and the holder does not thereby incur the responsibility of an indorser.

According to Section 55, if a negotiable instrument, after having been indorsed in bank, is indorsed in full, the amount of it cannot be claimed from the indorser in full, except by the person to whom it has been indorsed in full, or by one who derives title through such person.

Example 26: A is the payee holder of a bill. A indorses it in blank and delivers it to B. B indorses it in full to c or order. C without indorsement transfers the bill to

D. D as the bearer is entitled to receive payment or to sue drawer, acceptor, or A who indorsed the bill in blank, but he cannot sue B or C. C can sue B as he received the bill form by indorsement in full. If, however, C instead of passing the bill to D without indorsement passes it by a regular indorsement, D can claim against all prior parties.

Thus, if an indorsement in blank is followed by an indorsement in full, the instrument still remains payable to bearer and negotiable by delivery against all parties prior to the indorser in full, though the indorser in full is only liable to a holder who made title directly through his indorsement, and person deriving title through such holder.

Essentials of a valid indorsement

- Signature of indorser: The indorsement must be signed. The indorsement may be made by the indorser either by merely signing his name on the instrument or by specifying in addition to his signature, the person to whom or to whose order the instrument is payable. When, in a bill payable to order, the indorsee’s name is wrongly spelled, he should when he indorses it, sign the name as spelled in the instrument and write the correct spelling within brackets after his indorsement.

- Who may indorse or negotiate- Every sole maker, drawer, payee or indorsee, or all of several joint makers, drawers, payees or indorsee’s of a negotiable instrument may indorse and negotiate the same unless negotiability of such instrument has been restricted or excluded as mentioned in Sec. 50.

Explanation: It is however, necessary that such maker or drawer who wants to indorse is in lawful possession of the instrument. (Section 51)

Example 27: A bill is drawn payable to A or order. A indorses it to B, the indorsement not containing the words “or order” or any equivalent words. B may negotiate the instrument.

- Effect of indorsement: The indorsement of a negotiable instrument followed by delivery transfers to the indorsee the property therein with the right of further negotiation, but the indorsement may by express words, restrict or exclude such right, or may merely constitute the indorsee an agent to indorse the instrument, or to receive its contents for the indorser, or for some other specified person.

Example 28: B signs the following indorsements on different negotiable instruments payable to bearer,—

- “pay the contents to C only”.

- “pay C for my use”.

- “pay C on order for the account to B”.

- “the within must be credited to C”.

These indorsements exclude the right of further negotiation by C.

- “pay C”.

- “pay C value in account with the Oriental Bank”.

- “pay the contents to C, bring part of the consideration in a certain deed of assignment executed by C to indorser and others”.

These indorsements do not exclude the right of further negotiation by C.

Indorser who excludes his own liability or makes it conditional [Section 52]

The indorser of a negotiable instrument may,

- by express words in the indorsement, exclude his own liability thereon, or

- make such liability or the right of the indorsee to receive the amount due thereon depend upon the happening of a specified event, although such event may never happen.

Where an indorser so excludes his liability and afterwards becomes the holder of the instrument all intermediates indorsers are liable to him.

Example 29:

- The indorser of a negotiable instrument signs his name, adding the words “without recourse”. Upon this indorsement he incurs no liability.

- A is the payee and holder of a negotiable instrument. Excluding personal liability by an indorsement, “without recourse”, he transfers the instrument to B, and B indorses it to C, who indorses it to A. A is not only reinstated in his former rights, but has the rights of an indorsee against B and C.

INSTRUMENT OBTAINED BY UNLAWFUL MEANS OR FOR UNLAWFUL CONSIDERATION [SECTION 58]

- When a negotiable instrument has been lost, or

- has been obtained from any maker, acceptor or holder thereof by means of an offence or fraud, or for an unlawful consideration,

no possessor or indorsee who claims through the person who found or so obtained the instrument is entitled to receive the amount due thereon from such maker, acceptor or holder, or from any party prior to such holder, unless such possessor or indorsee is, or some person through whom he claims was, a holder thereof in due course.

INSTRUMENT ACQUIRED AFTER DISHONOR OR WHEN OVERDUE [SECTION 59]

The holder of a negotiable instrument, who has acquired it after dishonour, whether by—

- non-acceptance

- or non-payment,

- with notice thereof, or

- after maturity,

has only, as against the other parties, the rights thereon of his transferor.

Accommodation note or bill: Provided that any person who, in good faith and for consideration, becomes the holder, after maturity, of a promissory note or bill of exchange made, drawn or accepted without consideration, for the purpose of enabling some party thereto to raise money thereon, may recover the amount of the note or bill from any prior party.

Example 30: The acceptor of a bill of exchange, when he accepted it, deposited with the drawer certain goods as a collateral security for the payment of the bill, with power to the drawer to sell the goods and apply the proceeds in discharge of the bill if it were not paid at maturity. The bill not having been paid at maturity, the drawer sold the goods and retained the proceeds, but indorsed the bill to A. A’s title is subject to the same objection as the drawer’s title.

Instrument negotiable till payment or satisfaction [Section 60]

A negotiable instrument may be negotiated (except by the maker, drawee or acceptor after maturity) until payment or satisfaction thereof by the maker, drawee or acceptor at or after maturity, but not after such payment or satisfaction.

Cancellation of indorsement: Where the holder of a negotiable instrument, without the consent of the indorser, destroys or impairs the indorser’s remedy against a prior party, the indorser is discharged from liability to the holder to the same extent as if the instrument had been paid at maturity (Sec. 40).

Example 31: A is the holder of a bill of exchange made payable to the order of B. which contains the following indorsements in blank: 1st indorsement - ‘B’, 2nd indorsement - C, 3rd indorsement - D, 4th indorsement – E. A puts this bill in suit against C and strikes out, without E’s consent, the indorsements by C and D. A is not entitled to recover anything from E.

Negotiation Back (“taking up of a bill”)

In the course of negotiation, if a negotiable instrument is circulated/negotiated back by an indorser to any of the prior party on the negotiable instruments it is termed as negotiation back. The person who becomes the holder in due course under this negotiation back cannot make any of the intermediate indorsers liable on the instruments. But where an indorser had excluded his liability, by the use of the words ‘sans recourse’ or ‘without recourse to me’ and after that becomes the holder of the instrument in his own right under the ‘negotiation back’ all intermediate Indorsers are liable to him and in case of dishonour, he can recover the amount from all or any one of them.

11. DISCHARGE FROM LIABILITY ON NOTES, BILLS AND CHEQUES

When a party, who is liable on a negotiable instrument, ceases to be liable he is said to be discharged from liability. Discharge from liability of a party to an instrument is different from the discharge of negotiable instrument itself. When only some of the parties to an instrument are discharged from liability but others continue to be liable thereon, it is only discharge of some of the parties from liability.

When the rights against all the parties on an instrument come to an end, the instrument is discharged. After the instrument is discharged no person, even a holder in due course, can claim the amount of the instrument from any party thereto.

Thus, when the maker of a promissory note or the acceptor of a bill is discharged, all the other parties liable on the instrument are automatically discharged and in that case the instrument itself is deemed to be discharged. So long as the instrument is discharged it can continue to be negotiated.

Chapter VII (Sections 82 to 90) of the Negotiable Instruments Act, 1881, deal with the discharge of the parties to a negotiable instrument.

Modes of discharge from liability on Instruments

The parties to a negotiable instrument may be discharged in the following ways:

As per section 82, the maker, acceptor or indorser of a negotiable instrument is discharged from liability thereon by cancellation, release or payment. Further, there are other modes of discharge of liability that co-exist (along with section 82) as prescribed under various sections of the Negotiable Act.

Thus, the parties to the negotiable instrument may be discharged in the following ways—

(a) By cancellation [Section 82 (a)]

When the holder of a negotiable instrument or his agent cancels the name of a party on the instrument with an intention to discharge him, such party and all subsequent parties, who have a right of recourse against the party whose name is cancelled, are discharged from liability to the holder.

(b) By release [Section 82 (b)]

Where the holder of a negotiable instrument releases any party to the instrument by any method other than cancellation, the party so released is discharged from liability.

For example discharge by an agreement between the parties, and includes waiver, release, accord and satisfaction.

The party so released and all parties subsequent to him who have a right of action against the party so released are discharged from liability. Thus, the effect of release is the same as that of cancelling a party’s name.

When payment on an instrument is made in due course, both the instrument and the parties to it are discharged subject to the provision of Sec. 82(c). The payment on an instrument may be made by any party to the instrument. It may even be made by a stranger provided it is made on account of the party liable to pay.

(b) By the holder allowing the drawee of a bill more than 48 hours to accept [Section 83]

If the holder of a bill of exchange allows the drawee more than forty eight hours, exclusive of public holidays, to consider whether he will accept the same, all previous parties not consenting to such allowance are thereby discharged from liability to such holder.

(c) By the Holder agreeing to a qualified or limited acceptance of bill of exchange [Section 86]:

If the holder of a bill agrees to a qualified acceptance all prior parties whose consent is not obtained to such an acceptance are discharged from liability. Acceptance of a bill is deemed to be qualified, for example, when the acceptance is conditional, declaring the payment to be dependent on the happening of an event therein stated, or wherein alters the payment of the sum ordered to be paid, or when the acceptor accepts to pay at a specified place only and not elsewhere.

(d) By the Drawer not duly presenting a cheque for payment [Section 84]:

If a holder does not present a cheque within reasonable time after its issue, and the bank fails causing damage to the drawer, the drawer is discharged as against the holder to the extent of the actual damage suffered by him.

Example 32: “A draws a cheque for ` 1000 and, when the cheque ought to be presented, has funds at the bank to meet it. The bank fails before the cheque is presented. The drawer is discharged, but the holder can prove against the bank for the amount of the cheque”.

Example 33: “A draws a cheque at Ambala on a bank in Kolkata. The bank fails before the cheque could be presented in ordinary course. A is not

discharged, for he has not suffered actual damage through any delay in presenting the cheque”.

(a) By the bill coming to the acceptor’s hands after maturity (Section 90)

If a bill of exchange which has been negotiated is, at or after maturity, held by the acceptor in his own right, all rights of action thereon are extinguished. This rule is based on the general principle that a present right and liability united in the same person cancel each other.

(b) Discharge by material alteration

“Any material alteration of negotiable instruments renders the same void as against anyone who is a party thereto at the time of making such alteration and does not consent thereto, unless it was made in order to carry out the common intention of the original parties” (First para, Section 87)

The second para of section 87 provides that “if a material alteration is made by an indorsee, the indorser will be discharged from his liability even in respect of the consideration thereof.” If the holder of a negotiable instrument makes a material alteration of instrument he loses his right of action against those parties who would otherwise have been liable towards him.

The provisions of Section 87 are subject to those of sections 20, 49, 86 and

- It is generally an accepted rule of law that a material alteration of an instrument by a party to it, without the consent of the other party, renders it void.

By material alteration the identity of original instrument is destroyed and those parties who had agreed to be liable on the original instrument cannot be made liable on the new contract contained in the altered instrument to which they never consented (Gour Chandra vs Prasanna Kumar 33 Cal 812). It makes no difference whether the alteration is made by a party who is in possession of the same, or by a stranger while the instrument was in the custody of a party, because the party in custody of instrument is bound to preserve it in its integrity. The rule is defended on the ground that no man shall be permitted to take the chance of committing a fraud without running any risk of loss by the event when it is detected.

The party who consents to the alteration as well as the party who makes the alteration are disentitled to complain against such alteration e.g. the drawer of the cheque himself altered the date of the cheque for validating or re- validating the same instrument, he cannot take advantage of it by saying that the cheque becomes void as there was a material alteration thereto. It is

always open to a drawer to voluntarily re-validate a negotiable instrument including a cheque [Veera Exports v T. Kalavathy (2002) 1 SCC97].

Alteration must be material: An alteration is material which in any way alters the operation of the instrument and affects the liability of parties thereto.

Any alteration is material

- which alters the business effect of the instrument if used for any business

- which causes it to speak a different language in legal effect form which it originally spoke or which changes the legal identity or character of the

By material alteration, the liability of the parties is avoided, whether the change be prejudicial or beneficial to the parties. A material alteration is one which varies the rights, liabilities or legal position of the parties as ascertained by the original instrument [Loonkaran sethiya v Ivan E. John (1977) SCC].

“The following alteration are specifically declared to be material: any alteration of (i) the date, (ii) the sum payable, (iii) the time of payment, (iv) the place of payment, or the addition of a place of payment.”

Following are the examples of material alteration: -

- Alteration of date e.g., time of payment accelerated or postponed, or where date in the instrument inserted subsequent to the execution of instrument (A. Subba Reddy v Neelapa Reddy AIR 1966 P. 267).

- Alteration of rate of interest (if specified) [Seth Tulsidas Lalchand v Rajagopal (1967) 2 MLJ 66].

- Alteration of the sum payable, g., a bill for ` 5000 altered into a bill for ` 500.

- Alteration in the time of payment, g., a bill payable 3 months after date is altered to be payable 1 month after date.

- Alteration of the place of payment g., change of bank at which the bill is payable [Tidamarsh v Grover (1813) 23 LJ QB 261]. Likewise, alteration by addition of place for payment e.g. where a place of payment is not given but is subsequently added without the acceptor’s consent.

- Alteration by addition of parties (from one maker/payee to two makers/payees).

- Alteration by tearing material part of the

- Alteration by increasing or affixing stamps (Challamma v Padmanabhan Nair 1970 KLR 682).

- Alteration by erasure of an “account payee” crossing (J. Ladies Beauty v State Bank of Indian AIR 1984 Guj33].

- Alteration of an order cheque to a bearer cheque, except by or with consent of the

The following alterations do not affect the liability of parties thereto:

- If the alteration is unintentional and due to pure accident (e.g. accidental disfigurement of document).

- Alteration made by a stranger without the consent of holder and without any fraud and negligence on his

- An alteration made to correct a clerical error or a mistake, thus, if instead of 1823, the date entered was 1832, the agent of drawer held entitled to correct mistake [Brutt v pikard (1824) Ry & M 37]. Such correction is deemed to be giving effect to the original intention of the

- Alteration made to carry out common intention of original parties is permitted by Section 87. For example, where the words “or order” after the name of payee, inserted subsequently [Byrom v Thomson (1839) 11 A&E 31].

- Alteration with the consent of the parties liable

- An alteration made before the completion or the issue of negotiable

- A material alteration doesn’t affect the liability of those parties who become liable after the alteration is made. Section 88 provides that the acceptor or indorser is bound by his acceptance or indorsement notwithstanding any previous alteration of the

- An alteration which is not material e.g. when a bill payable to bearer is converted to bill payable to order/or an incomplete name of a person converted into the complete name of same

- Alterations permitted (Exceptions to Section 87)

- Section 20 – Incomplete instrument (e.g. column of sum left blank) can be filled up by the

- Section 49 – It enables the holder of an instrument indorsed in blank to convert it into indorsement in full (by writing above the indorser’s signature a direction to pay to any other person as indorsee). Thus, addition of parties allowed

- Section 125- the holder of an uncrossed cheque may cross it or may convert general into special crossing or may make it ‘not negotiable’.

- Apparent alteration – The alteration should be apparent on the face of the instrument otherwise it remains a valid security in the hands of a holder in due Section 89 provides that where an instrument has been materially altered but does not appear to have been so altered, the party paying it will be discharged by payment in due course.

But in such case, the acceptor is liable only for the original tenor of the instrument and not for its altered tenor.

Similarly, where a cheque at the time of presentment is crossed but the crossing is not apparent, the banker will be discharged by payment in due course.

Example 34: A promissory note was made without mentioning any time for payment. The holder added the words “on demand” on the face of the instrument. As per the above provision of the Negotiable Instruments Act, 1881 this is not a material alteration as a promissory note where no date of payment is specified will be treated as payable on demand. Hence adding the words “on demand” does not alter the business effect of the instrument.

Example 35: The alterations made in the given case are not material alterations in nature:

(i) The holder of the bill inserts the word “or order” in the bill,

(ii) The holder of the bearer cheque converts it into account payee cheque,

The following material alterations have been authorised by the Act and do not require any authentication:

- filling blanks of inchoate instruments [Section 20]

Conversion of a blank indorsement into an indorsement in full [Section 49]

12.DISHONOUR OF NEGOTIABLE INSTRUMENTS

Dishonour of a bill

A bill may be dishonoured by:

- Non-acceptance, or

- Non-payment.

Dishonour by Non-acceptance

A bill of exchange is said to be dishonoured by non-acceptance in any one of the following ways (Section 91):

- When a bill is duly presented for acceptance, and the drawee, or one of several drawees not being partners, refuse acceptance within forty eight hours from the time of presentment, the bill is dishonored. In other words, when the drawee makes default in acceptance upon being duly required to accept the

- where presentment is excused, and the bill is not

- Where the drawee is incompetent to contract, the bill may be treated as

- Where the drawee is a fictitious person.

- Where the drawee could not be found even after reasonable search

- When a drawee gives a qualified acceptance, the holder may treat the instrument

The effect of dishonoured by non-acceptance is that the holder of the bill can start an action against the drawer and the indorsers and need not wait for maturity of the bill.

Dishonour by non-payment

A promissory note, bill of exchange and cheque is said to be dishonoured by non- payment when the maker of the note, acceptor of the bill or drawee of the cheque makes default in payment upon being duly required to pay the same (Sec. 92).

Dishonour by non-payment

A promissory note, bill of exchange and cheque is said to be dishonoured by non- payment when the maker of the note, acceptor of the bill or drawee of the cheque makes default in payment upon being duly required to pay the same (Sec. 92).

Again, a negotiable instrument is dishonoured by non-payment when presentment for payment is excused and the instrument when overdue remains unpaid (Sec. 76).